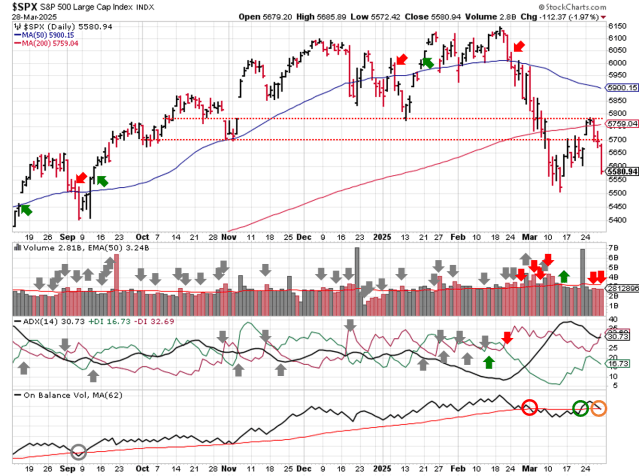

Stock Market Outlook entering the Week of April 6th = Downtrend

- ADX Directional Indicators: Downtrend

- Institutional Activity (Price & Volume): Downtrend

- On Balance Volume Indicator: Downtrend

ANALYSIS

The stock market outlook remains in a downtrend after a historic week for U.S. equities.

The S&P500 ( $SPX ) fell 9.1%. The index sits ~13% below the 50-day moving average and ~12% below the 200-day moving average. It’s worth nothing the two “gaps” in lasts week’s price action (5600 to 5500 and 5400 to 5300) as potential upside targets IF the market attempts to bounce this week.

SPX Price & Volume Chart for Apr 06 2025

The Average Directional Index ( ADX ) remains bearish. Massive selling last week keeps Institutional Activity showing a downtrend as well. On-Balance Volume ( OBV ) shifted back to bearish.

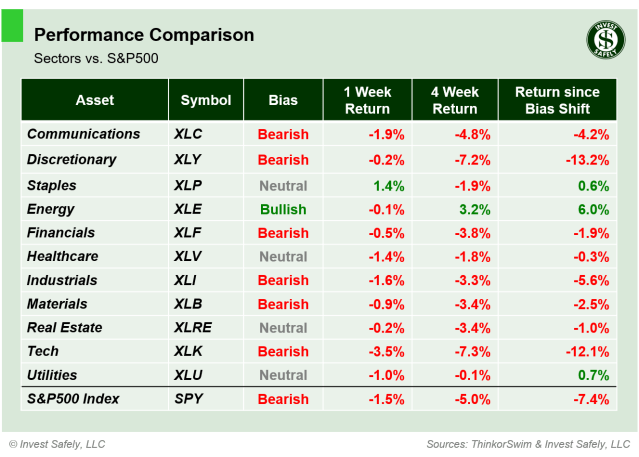

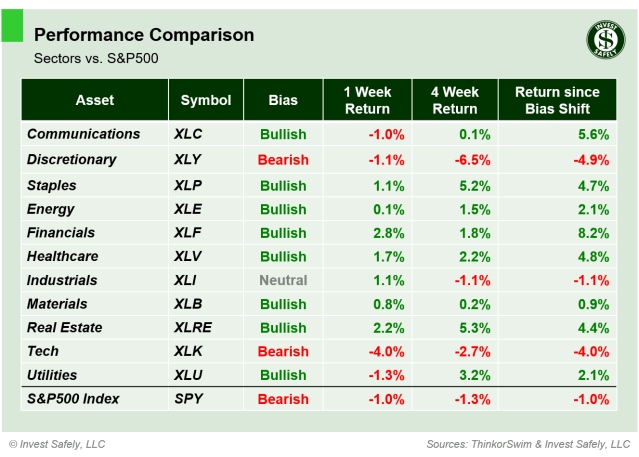

S&P Sector Performance for Week 15 of 2025

All sectors were down last week, with Technology ( $XLK ) leading for the second week in a row. Consumer Staples, Health Care, and Utilities ( $XLP, $XLV, $XLU ) joined all the other sectors with a Bearish bias.

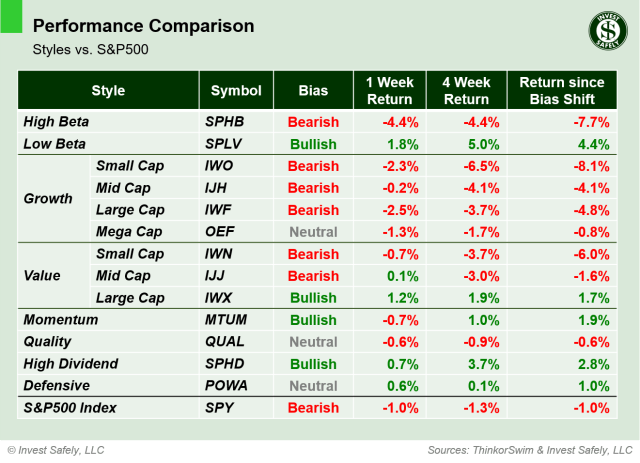

Sector Style Performance for Week 15 of 2025

High Beta ( $SPHB ) was the worst sector style last week. Low Beta ( $SPLV ) and High Dividend ( $SPHD ) joined the other styles with a Bearish bias.

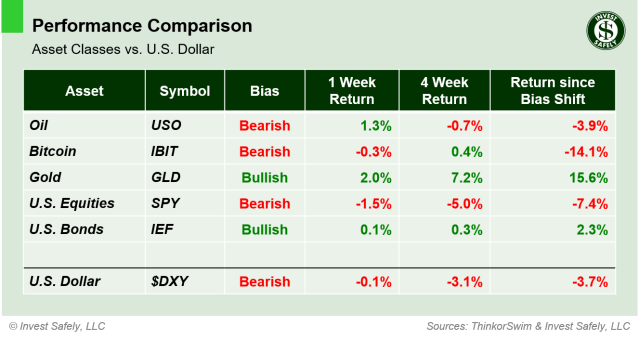

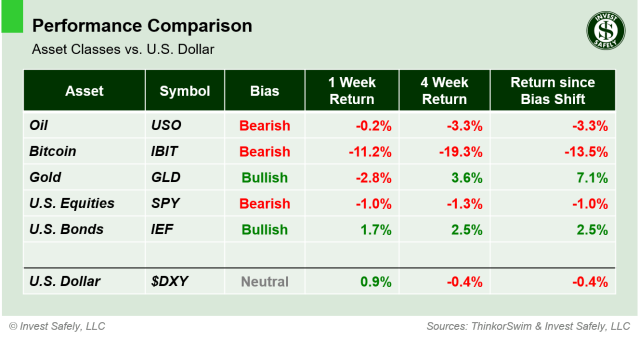

Asset Class Performance for Week 15 2025

Bonds ( $IEF ) were the best asset last week, while Oil ( $USO ) and US Equities were the worst. No change in bias.

COMMENTARY

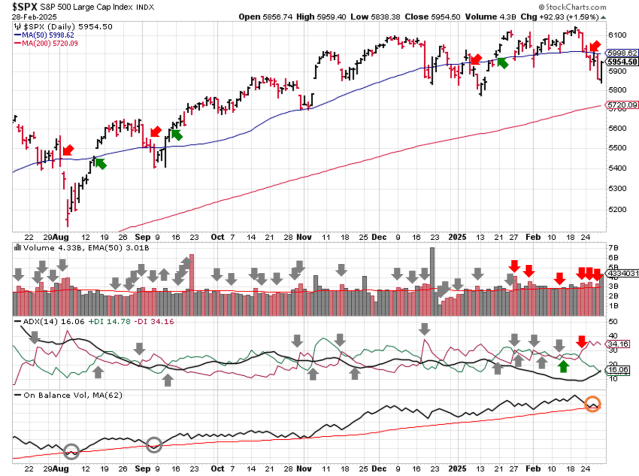

Last week was an extraordinary one for equity markets. Have you heard the saying “nothing good happens after midnight”? Well, nothing good happens under the 200-day moving average either.

Over the past two day trading days (4/4 – 4/5), the S&P500 fell 10.5%; only the 5th time happened since 1950! Bonds and Gold were the only safe havens, and even then, Gold sold off along with everything else.

Ideally, investors sell when and what they want to sell. It’s another reason to use a signaling process identify downtrends and adjust holdings. But there are times when investors are forced to sell when and what they can sell (e.g. margin calls).

Prior to Thursday, selling was orderly ( $VIX lower than expected for the size of the price movement ), meaning that people were selling because they wanted to exit. But late Thursday and into Friday, we started seeing forced selling (i.e gold).

No one knows what is going to happen this week, but there’s no shortage of opinions flying around on social media. In the midst of uncertainty, everyone scrambles for some kind of narrative, some kind of story, to explain the current situation. In the end, it’s price that matters, not the narrative.

At the time of this post, Asian equity markets are down significantly ( Japan is down more than 8% ), and U.S. futures are 3% lower. Don’t try to “catch a falling knife”. Prices will recover eventually, and tickers on sale today will still be on sale when the bias moves back to bullish.

Q1 earnings season starts this week with big banks likely providing more insight on tariffs and the impact on forward guidance.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.