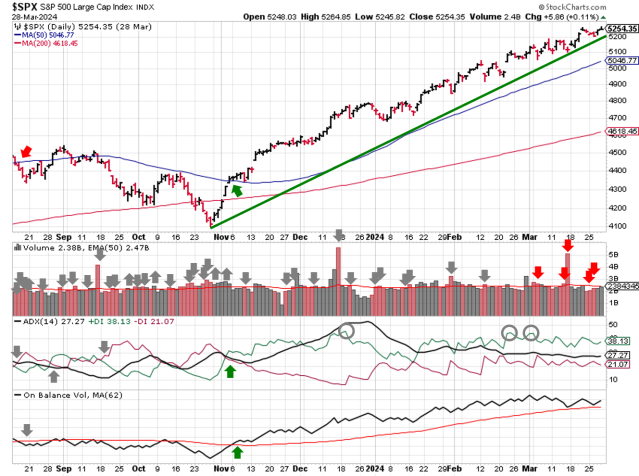

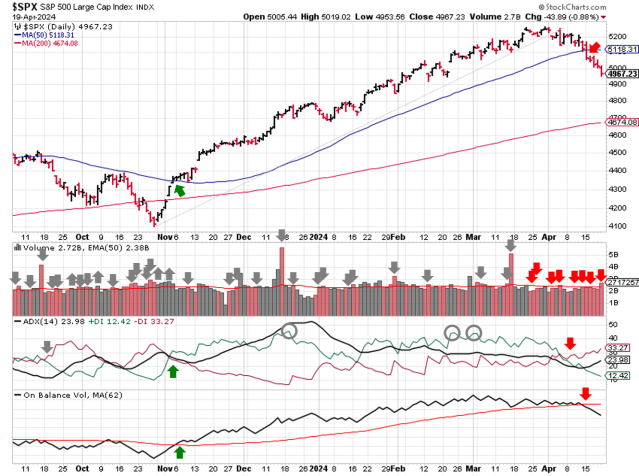

Stock Market Outlook entering the Week of April 21st = Downtrend

- ADX Directional Indicators: Downtrend

- Price & Volume Signals: Downtrend

- On Balance Volume Indicator: Downtrend

ANALYSIS

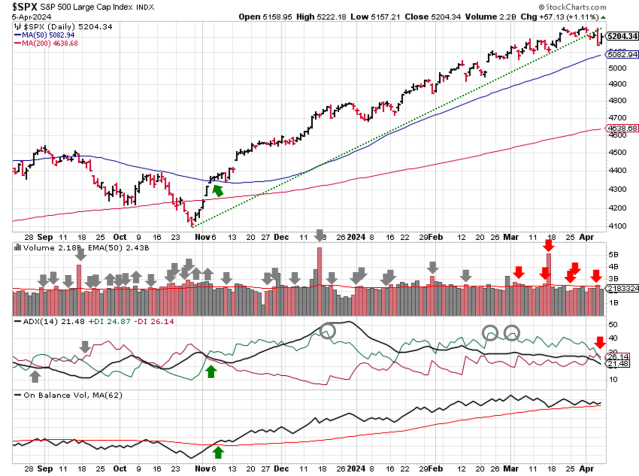

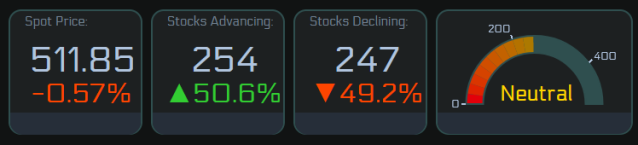

The stock market outlook begins the week in a downtrend, after confirmation during last Monday’s session.

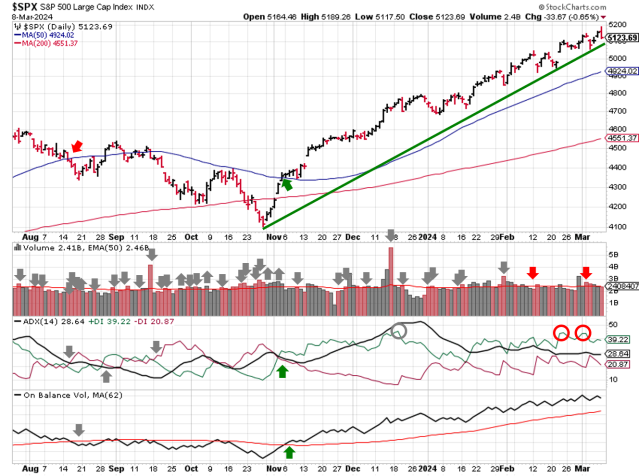

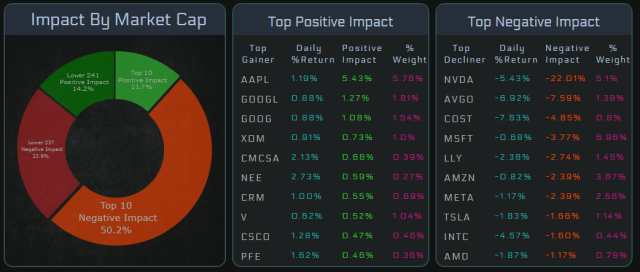

The S&P500 ($SPX) dropped 3% last week, with sellers in control each day. The index sits ~3% below the 50-day and ~6% above the 200-day moving average.

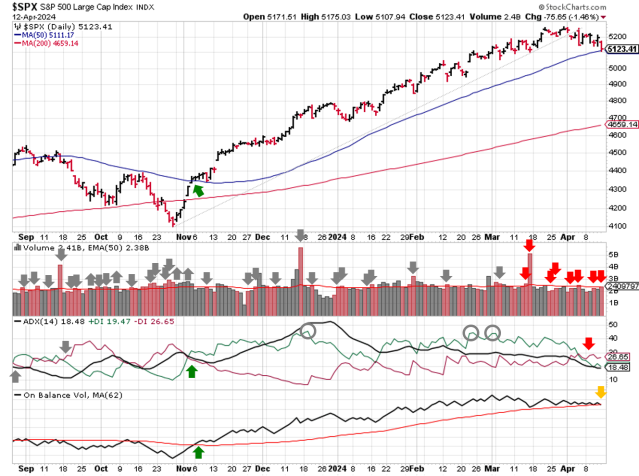

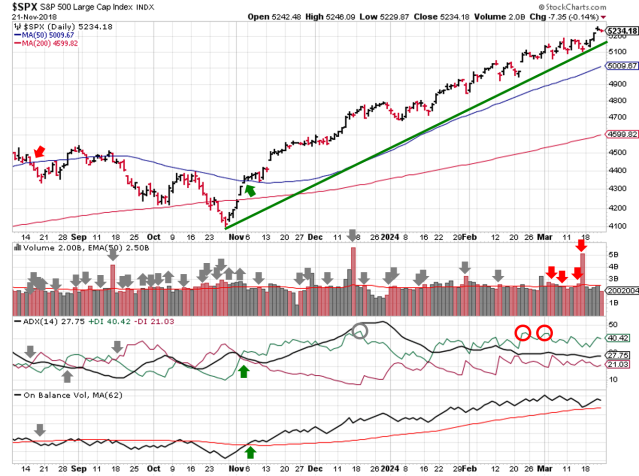

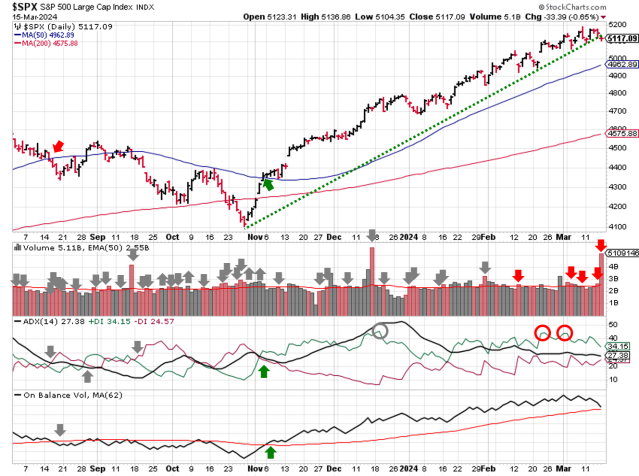

SPX Price & Volume Chart for the Week of Apr 21 2024

All three technical indicators are in confirmed downtrends. Price/volume joined the ADX in bearish territory on Monday, after slicing through the 50-day moving average and confirming the downtrend signal. The price/volume action also pushed OBV into a downtrend.

In total, the SPX gained ~16% (704 points) between the uptrend initiation on November 3 (4358) and the start of the downtrend last Monday (5062). Now, the outlook is in capital preservation mode until signs of the next rally. Fortunately, money market funds offer attractive alternatives these days, thanks to higher interest rates.

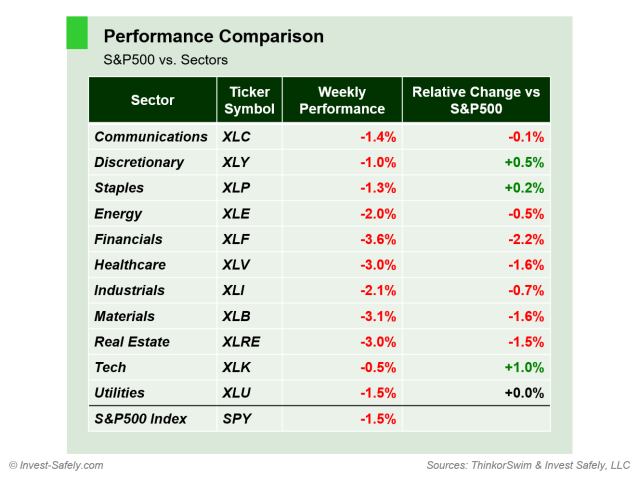

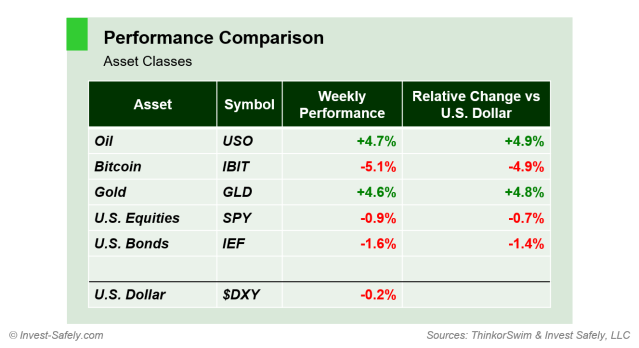

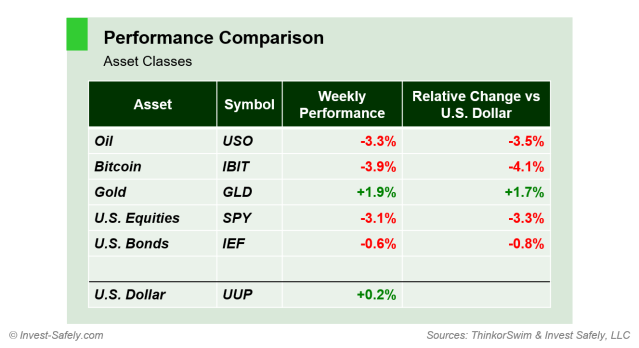

Asset Class Performance for Week 16 of 2024

Gold was the best asset class for the second week in a row, rising 2%. Bitcoin led to the downside, although Oil and US Equities weren’t far behind.

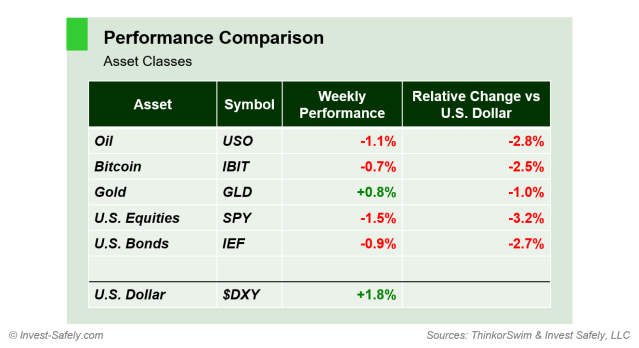

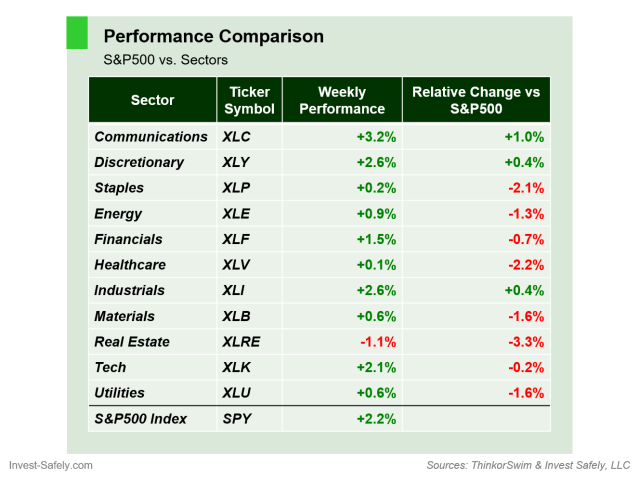

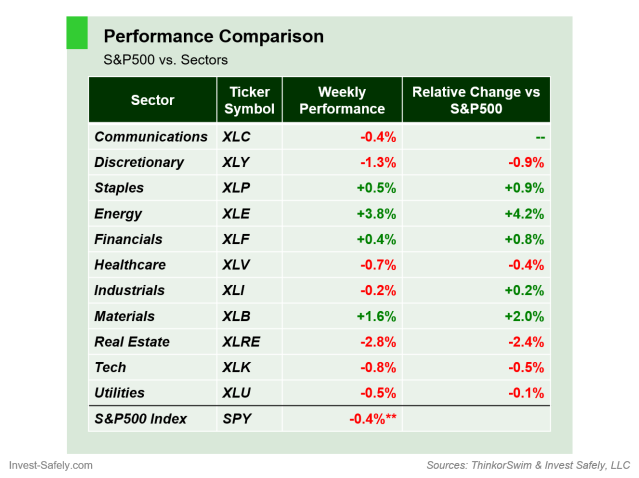

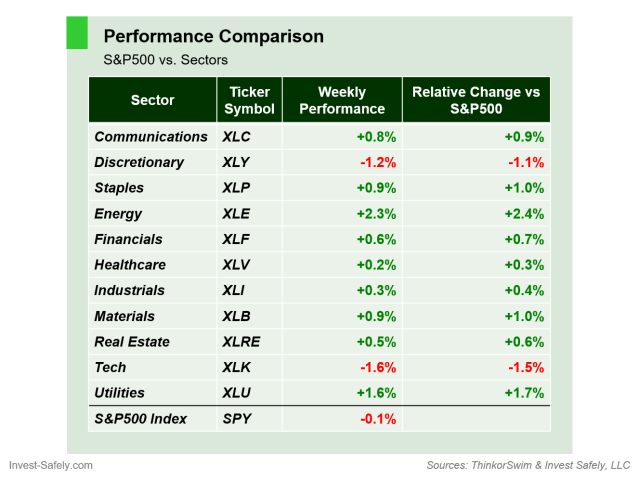

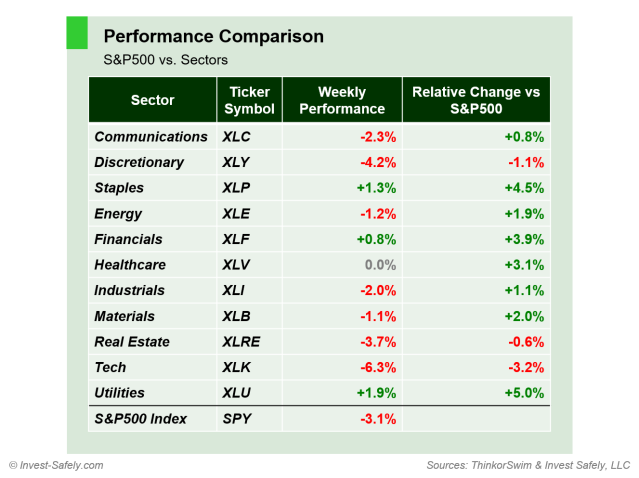

Within major equity sectors, Technology ($XLK) was the biggest loser, dropping over 6%, while Utilities ($XLU) gained ~2%.

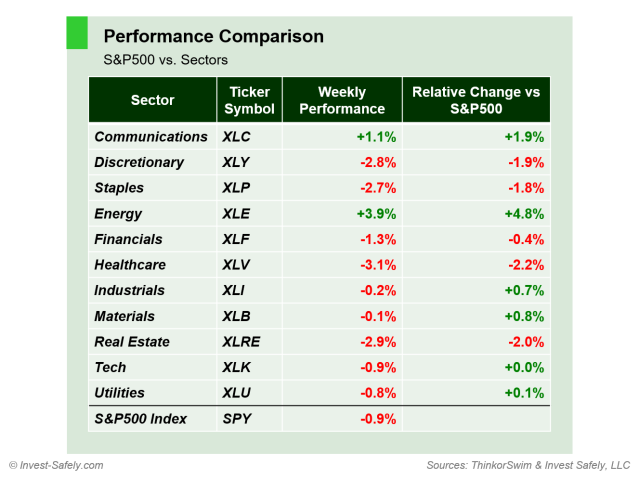

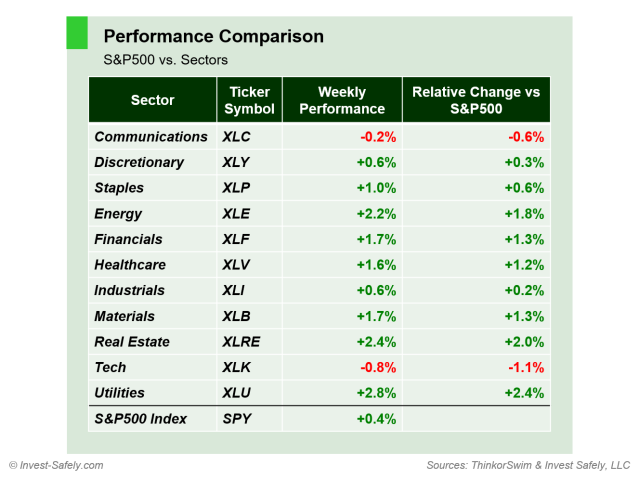

S&P Sector Performance for Week 16 of 2024

COMMENTARY

For the first time since Q3 last year, “buy the dip” gave way to “sell the rip”. Even “better than expected” Q1 earnings couldn’t stem the tide of selling. Instead, investors focused on weaker forward guidance, as well as higher-for-longer interest rates and geopolitics.

Last Tuesday, Federal Reserve Chairman Powell spoke at a forum on U.S.-Canada economic relations. His comments on inflation threw cold water on the rate-cut crowd and sent longer-term interest rates higher:

“The recent data have clearly not given us greater confidence, and instead indicate that it’s likely to take longer than expected to achieve that confidence.”

“We can maintain the current level of restriction for as long as needed.”

Thursday evening, Israel conducted airstrikes against Iranian targets. The move came as a surprise to many, as most media outlets expected a delayed response due to religious holidays. Although the events took place outside of market hours, futures spiked; equities down, gold and oil up. Those knee-jerk reactions were undone by the time the market opened on Friday, but buyers weren’t motivated to put capital at risk in equities over the weekend.

A big week for Q1 earnings, with 4 of the “Magnificent 7” reporting: $MSFT, $GOOG/$GOOGL, $META, $TSLA. Microsoft, Google, and Meta combine for more than 12% of SPX market cap, so any surprises will have an outsized impact on index performance.

#earnings for the week of April 22, 2024

https://t.co/hLn2sKQhEY

$TSLA $META $MSFT $GOOGL $INTC $XOM $IBM $V $F $BA $VZ $CMG $GM $SNAP $ENPH $UPS $GE $T $CLF $OSIS $ROKU $NOW $PEP $LMT $FCX $RCL $VRT $WDC $HUM $SPOT $VKTX $AAL $NUE $NEM $MO $RTX $TXN $LRCX $CAT $CVX $JBLU $DXCM… pic.twitter.com/Tw2r43GFaw— Earnings Whispers (@eWhispers) April 18, 2024

Data-wise, most news outlets will focus on Friday’s release of March PCE, due to its impact on rate cut narratives. But we’ll also March Durable Goods orders (Wednesday morning) and the first (i.e. “advance”) estimate of Q1 GDP (Thursday morning).

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.