Stock Market Outlook entering the Week of March 24th = Uptrend

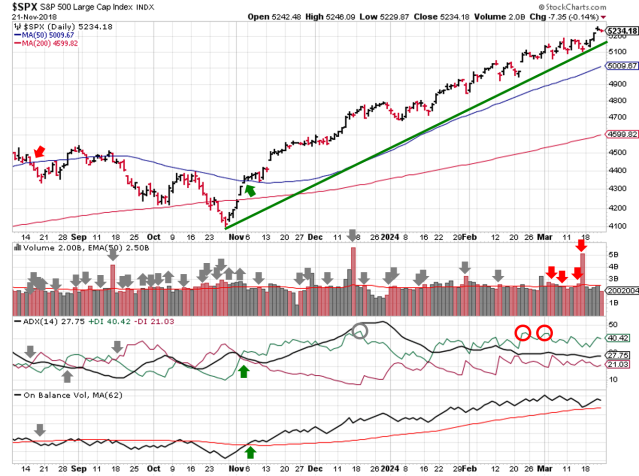

- ADX Directional Indicators: Uptrend

- Price & Volume Signals: Uptrend

- On Balance Volume Indicator: Uptrend

ANALYSIS

The stock market outlook shows an uptrend in place, as the $SPX ended the week just shy of another all time high.

The S&P500 ($SPX) rose just over 2% last week and re-established the long-term trendline. The index sits ~4.5% above the 50-day moving average, and ~14% above the 200-day moving average.

SPX Price & Volume Chart for the Week of Mar 24 2024

All three signals show an uptrend in place. Institutional selling was scarce last week, and On Balance Volume rebounded from its moving average.

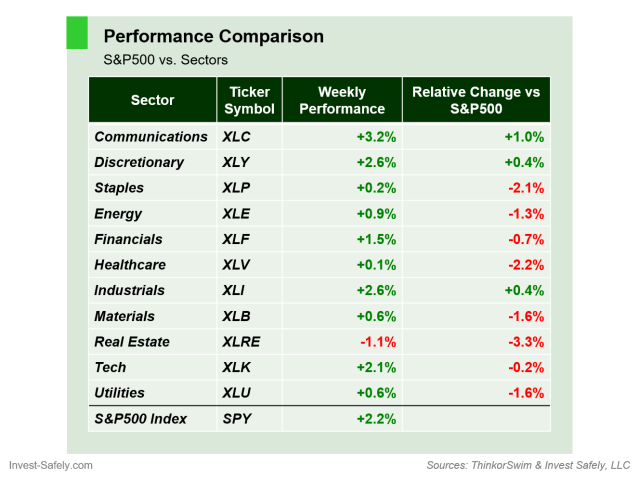

Communications ($XLC) outperformed the broader index last week, thanks in large part to its large weightings for Google ($GOOG/$GOOGL) and Meta ($META). Real estate ($XLRE) spent a second week in a row as the weakest sector, with Equinix ($EQIX) dragging down the sector after Hindenburg Research alleged senior management manipulated financial metrics to trigger executive stock grants.

S&P Sector Performance for the Week of Mar 24 2024

COMMENTARY

The FOMC left rates unchanged. And while Powell may not have delivered a rate cut, he did deliver a dovish press conference. Despite continued economic growth, low unemployment, and sticky inflation, the Fed still sees a total of 3 rate cuts this year, as well as the reduction of their quantitative tightening program. Expectations are for inflation to gradually fall back to 2%, although the path with be “bumpy”.

The Bank of Japan went the other direction and raised rates for the first time in 17 years. While the impact was small (from -0.1% to a range of 0.0% – 0.1%), it marks a move away from its negative interest-rate policy, and a potential change in profitability of the Yen Carry trade so many institutions use for low-risk arbitrage.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.