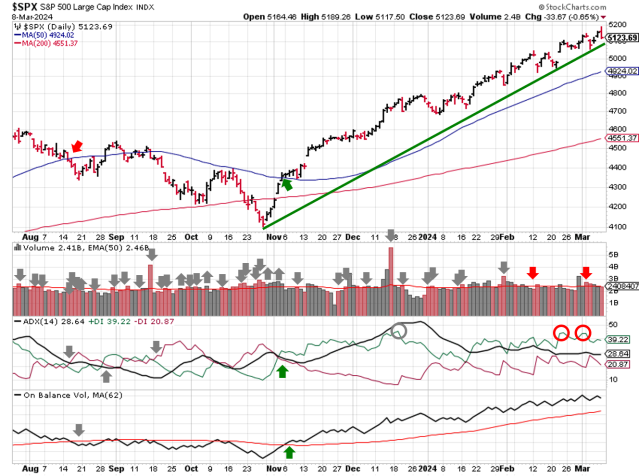

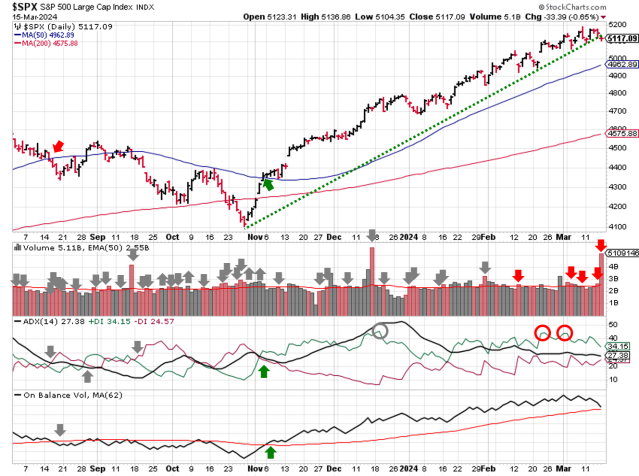

Stock Market Outlook entering the Week of March 17th = Uptrend

- ADX Directional Indicators: Uptrend

- Price & Volume Signals: Uptrend

- On Balance Volume Indicator: Uptrend

ANALYSIS

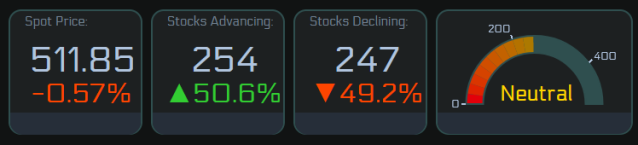

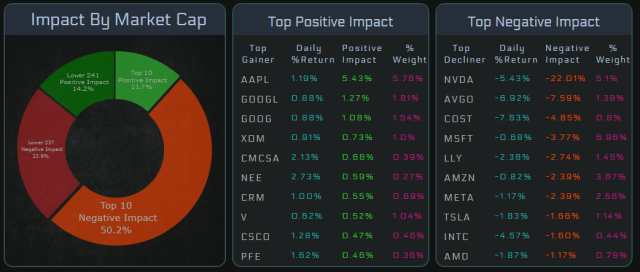

The stock market outlook shows an uptrend in place. Although the signals stayed the same, weakness crept onto the scene last week and suggests a consolidation period is at hand.

The S&P500 ($SPX) lost 0.1% last week, and closed just below the rally’s trendline. The index sits ~3% above the 50-day moving average, and 12% above the 200-day moving average (still historically elevated).

SPX Price & Volume Chart for the Week of Mar 17 2024

All three signals show an uptrend in place, but the equity market probably tests those levels in the days ahead. The index picked up a couple of distribution days last week, but option expiration masks the nature of Friday’s move. Still, the count is elevated at 5, with 4 occurring over the past 10 trading sessions. On Balance Volume remains above the 3 month average, but definitely weakened last week.

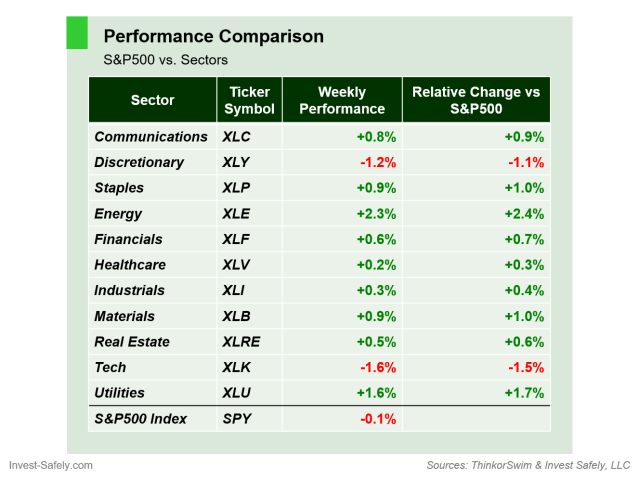

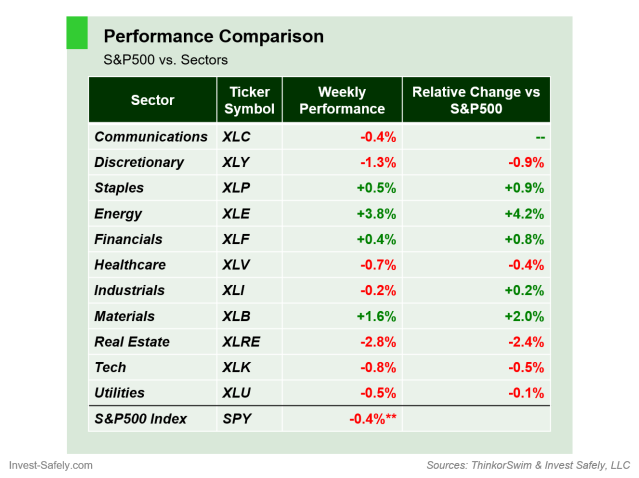

S&P Sector Performance for the Week of Mar 17 2024

The energy sector ($XLE) outperformed the broader index again last week, rising 3.8%, thanks in part to a bounce in the price of oil. Real estate ($XLRE) had a tough week; the sector sold off as long-term interest rates popped higher, in response to higher PPI data.

**Note: $SPY performance in the table above isn’t adjusted for last week’s dividend (gain of ~0.3%).

COMMENTARY

The odds of rate cuts before June have fallen dramatically over the past 2 months, as data shows inflation remains “sticky”.

February CPI was slightly higher than expected, for both core and headline figures, although core was down from last month.

| CPI(y/y) | Actual | Prior | Expected |

| Headline | +3.2% | +3.1% | +3.1% |

| Core | +3.8% | +3.9% | +3.7% |

February PPI, like CPI, was higher than expected, and also registered a jump in headline data.

| PPI(y/y) | Actual | Prior | Expected |

| Headline | +1.6% | +1.0% | +1.1% |

| Core | +2.0% | +2.0% | +1.9% |

In the absence of new PCE data (next release is March 29), higher than expected CPI/PPI data does not bode well for those still hoping the Fed cuts rates this Wednesday. Even a June rate cut, which was a certainty a few weeks ago, looks closer to a 50/50 proposition at this point.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.