Stock Market Outlook entering the Week of May 12th = Uptrend

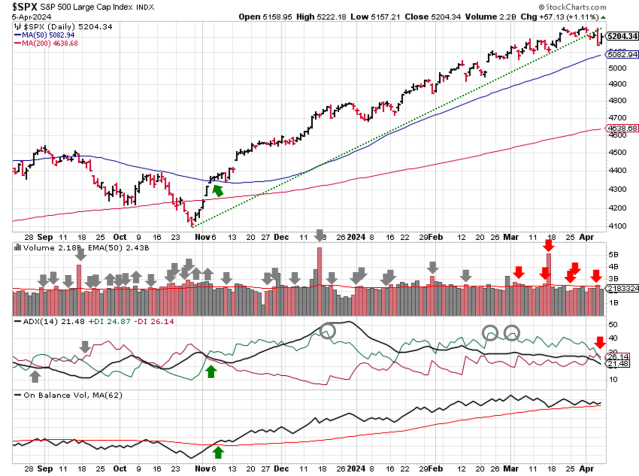

- ADX Directional Indicators: Uptrend

- Price & Volume Signals: Mixed

- On Balance Volume Indicator: Uptrend

ANALYSIS

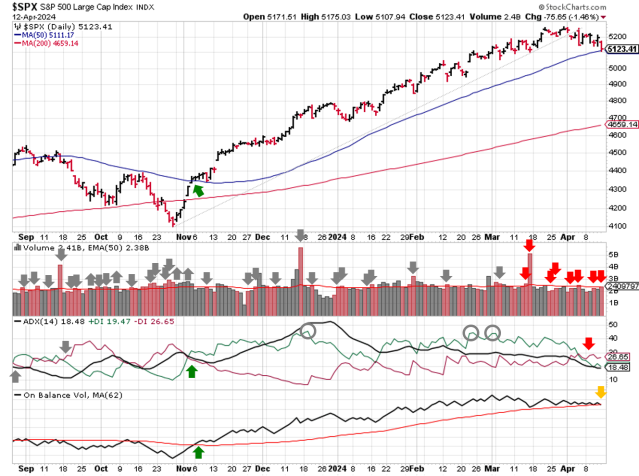

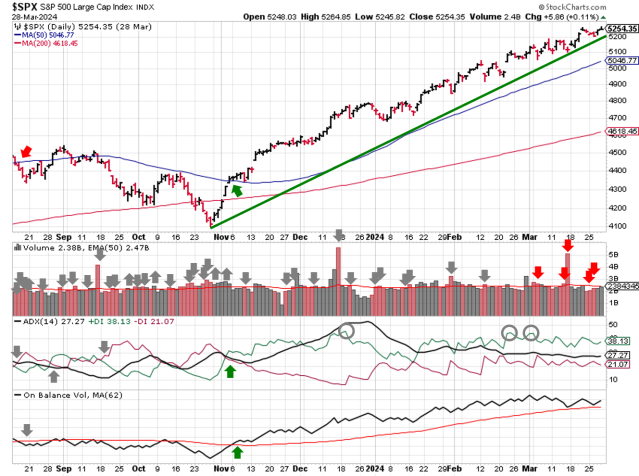

The stock market outlook shift back to an uptrend with two of the three signals in bullish territory.

The S&P500 ($SPX) rose 1.9% last week and now sits above the 50 and 200-day moving averages (~2% and ~11% respectively).

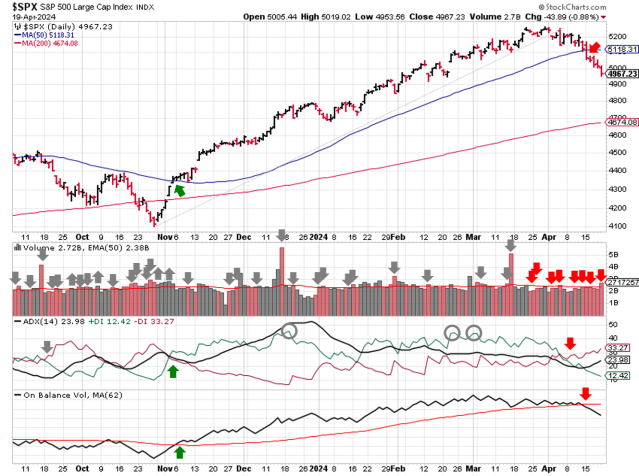

SPX Price & Volume Chart for the Week of May 12 2024

The ADX signal flipped back to bullish on Tuesday, followed by the On Balance Volume indicator on Friday. The combination shifted the outlook back to an uptrend.

Price volume shifts to mixed. Though the index continued higher last week, none of the up days have come with the necessary trading volume. Notice the similar trend in trading volume at the start of the last rally in early November (below average/declining while prices rise). This time, the 11 day window has passed, so caution is warranted.

Friday’s session also qualified as a “stalling day”, highlighting under-the-radar selling pressure. A stalling day occurs when trading volume is ~95% or more of the previous session, but there’s little to no price increase. It’s an easily overlooked type of distribution day because price doesn’t drop.

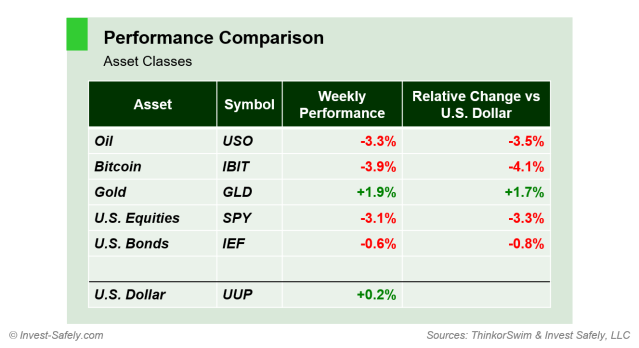

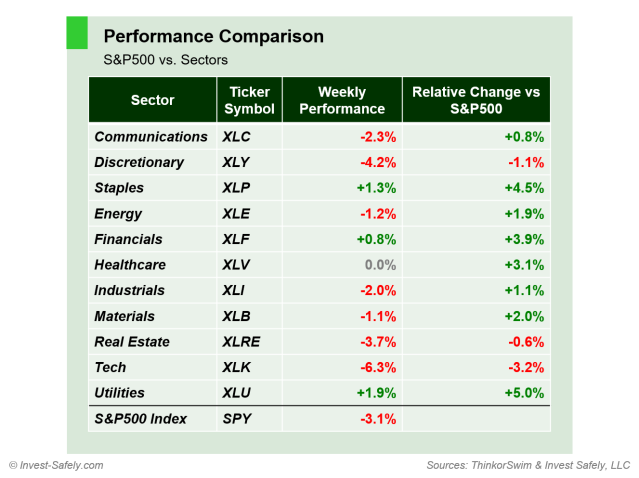

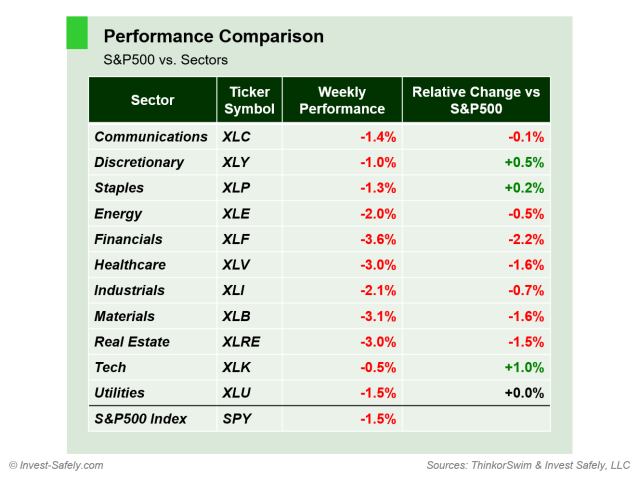

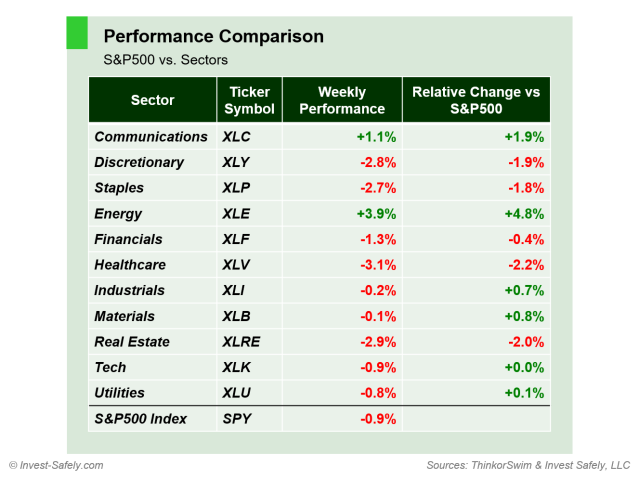

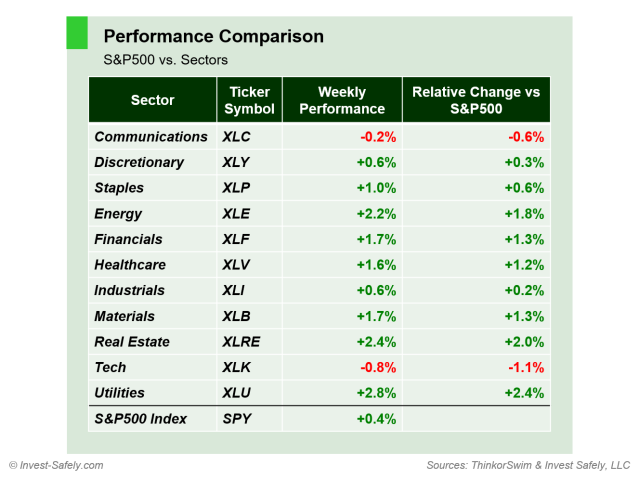

S&P Sector Performance for Week 19 of 2024

All sub-sectors of the S&P500 were green last week, with Utilities ($XLU) leading the way for a second week in a row. Consumer Discretionary ($XLY) was essentially flat for the week, thanks in large part to Amazon ($AMZN).

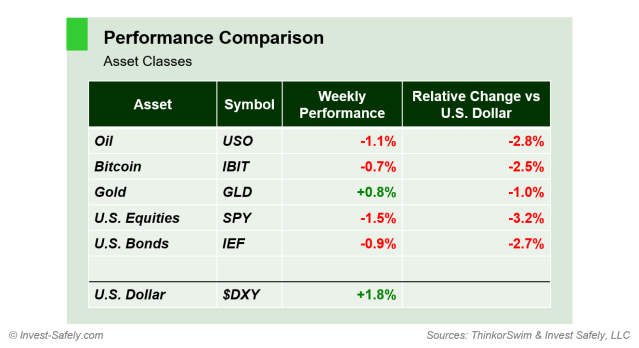

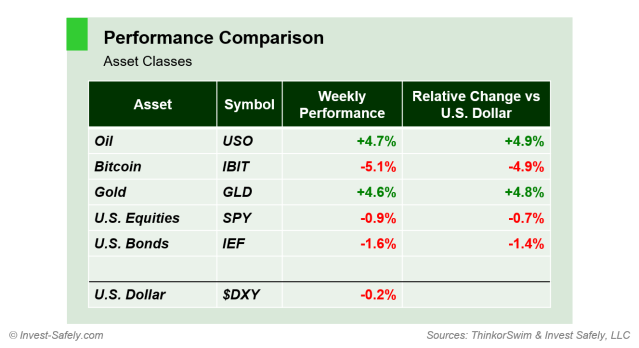

Gold returned to the winners circle last week, outpacing most asset classes by a wide margin, while Bitcoin continued its recent correction.

Asset Class Performance for Week 19 of 2024

COMMENTARY

~90% of the S&P500 have reported Q1 results; earnings are on pace to grow roughly 6% year over year.

Next week, the Bureau of Labor Statistics releases April inflation data (PPI/CPI) and Federal Reserve Chairman Powell speaks at the Foreign Bankers’ Association in Amsterdam. Monthly option expiration on Friday as well.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.