Stock Market Outlook entering the Week of May 5th = Downtrend

- ADX Directional Indicators: Downtrend

- Price & Volume Signals: Downtrend

- On Balance Volume Indicator: Downtrend

ANALYSIS

The stock market outlook remains in a downtrend, starting May in roughly the same position as it ended April.

The S&P500 ($SPX) rose 0.5% last week, reaching the 50-day moving average and sitting ~9% above the 200-day moving average.

SPX Price & Volume Chart for the Week of May 05 2024

The ADX signal is bearish heading into the week, and on-balance volume shows sellers remain in control.

Price/volume remains bearish, despite Friday’s gap higher. The session met the price increase criteria (+1.25%), but didn’t come with the needed trading volume. Instead, added volume came in the form of 2 distribution days.

There’s still time for the index to turn things around, but the odds of a robust rally drop further if the market doesn’t follow-through within 11 days (5/7).

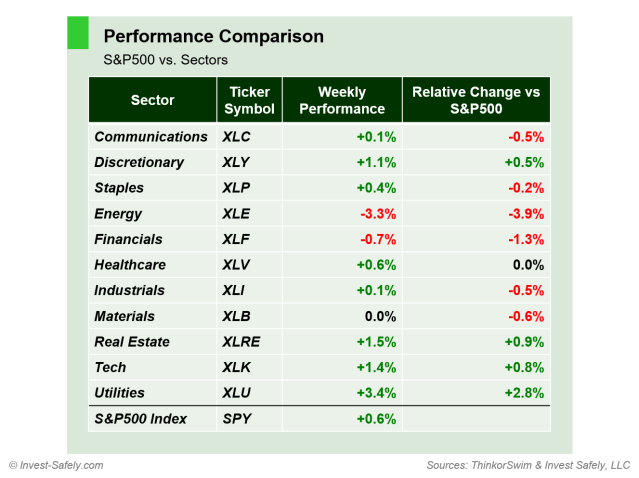

S&P Sector Performance for Week 18 of 2024

Within U.S. equities, most major sectors were green last week. Despite all the labor and inflation talk (and Apple earnings), Utilities ($XLU) outperformed the other sectors. Energy ($XLE) struggled again, largely due to the continued weakness in oil.

U.S. bonds were the best asset class last week, while oil dropped almost 7%.

Asset Class Performance for Week 18 of 2024

COMMENTARY

The big news last week was the “Powell Pivot” during the FOMC press conference on Wednesday. Did you miss it? That’s probably because the committee left rates unchanged, and said that inflation hadn’t come down as much as they had hoped. Or maybe it was the surprise statement that the Federal Reserve will begin tapering Quantitative Tightening in June.

But the real story was Powell’s remarks related to labor, and the renewed focus on employment, rather than inflation. Technically, the Federal Reserve’s dual mandate mean they equally split their focus between labor and inflation. But job data remained strong (at least according to lagging data sources), giving them cover to focus on inflation. It appears that now, the labor market will play a larger roll in determine the potential for rate cuts.

Markets also cheered Powell’s comments on the potential size and speed of any rate cuts later this year. When asked if he felt like the Federal Reserve was running out of time to get in “enough” rate cuts before year end, Powell flatly dismissed the notion. Fed watchers interpreted that as a willingness by Powell to use larger rate cuts, versus the prior 0.25% increments.

And as if on cue, Non-Farm Payrolls (NFP) came in lower than expected on Friday. Equities responded by gapping higher, while rates fell.

In other news, last week’s ISM manufacturing and services PMI surprised to the downside, showing a contraction in the April data.

And not to be outdone by the likes of Tesla, Apple ($AAPL) overcame a less than stellar financial results by increasing their dividend and unveiling a massive, $110B buyback program during their earnings announcement. That’s equivalent to the GDP of many small countries!

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.