Stock Market Outlook entering the Week of July 13th = Uptrend

- Average Directional Index: Uptrend

- Institutional Activity: Uptrend

- On Balance Volume: Uptrend

ANALYSIS

The stock market outlook shows a continuing uptrend for U.S. equities.

The S&P500 ( $SPX ) fell 0.3% last week. The index sits ~5% above the 50-day moving average and ~7% above the 200-day moving average.

All three technical indicators remain bullish after a lower volume consolidation during the week.

SPX Price & Volume Chart for July 13 2025

PERFORMANCE COMPARISONS

Energy ( $XLE ) outperformed the market index, while Communications and Financials ( $XLC & $XLF ) underperformed. Consumer Staples ( $XLP ) continues to struggle finding a direction, falling back to bearish bias.

S&P Sector Performance from Week 28 of 2025

Most sector styles struggled last week; High Beta ( $SPHB ) outperformed, Momentum ( $MTUM ) underperformed. Low Beta ( $SPLV ) slipped back to neutral bias.

Sector Style Performance from Week 28 of 2025

Bitcoin rallied more than 8%, as cryptocurrencies soared last week ( e.g. $ETHE , $OSOL ) leading asset class returns listed below. Gold ( $GLD ) was surprisingly quiet, given the outperformance seen by other metals like copper and palladium ( $CPER & $PALL ). Bonds ( $IEF ) continued their recent slide lower. Unfortunately, these moves suggest inflationary pressures, none of which supports the case for rate cuts. No changes to bias versus last weekend.

Asset Class Performance from Week 28 2025

COMMENTARY

In the absence of major macroeconomic headlines, U.S. tariffs took center stage. 14 countries received updated tariff “letters”, ranging from 25% to 40%, with a new implementation date of August 1. Markets took the announcements in stride; just the latest escalation in the ongoing trade war.

But over the weekend, the U.S. announced 30% tariffs on the European Union and Mexico; odds are this will provoke more of a reaction from markets when futures trading opens Sunday evening.

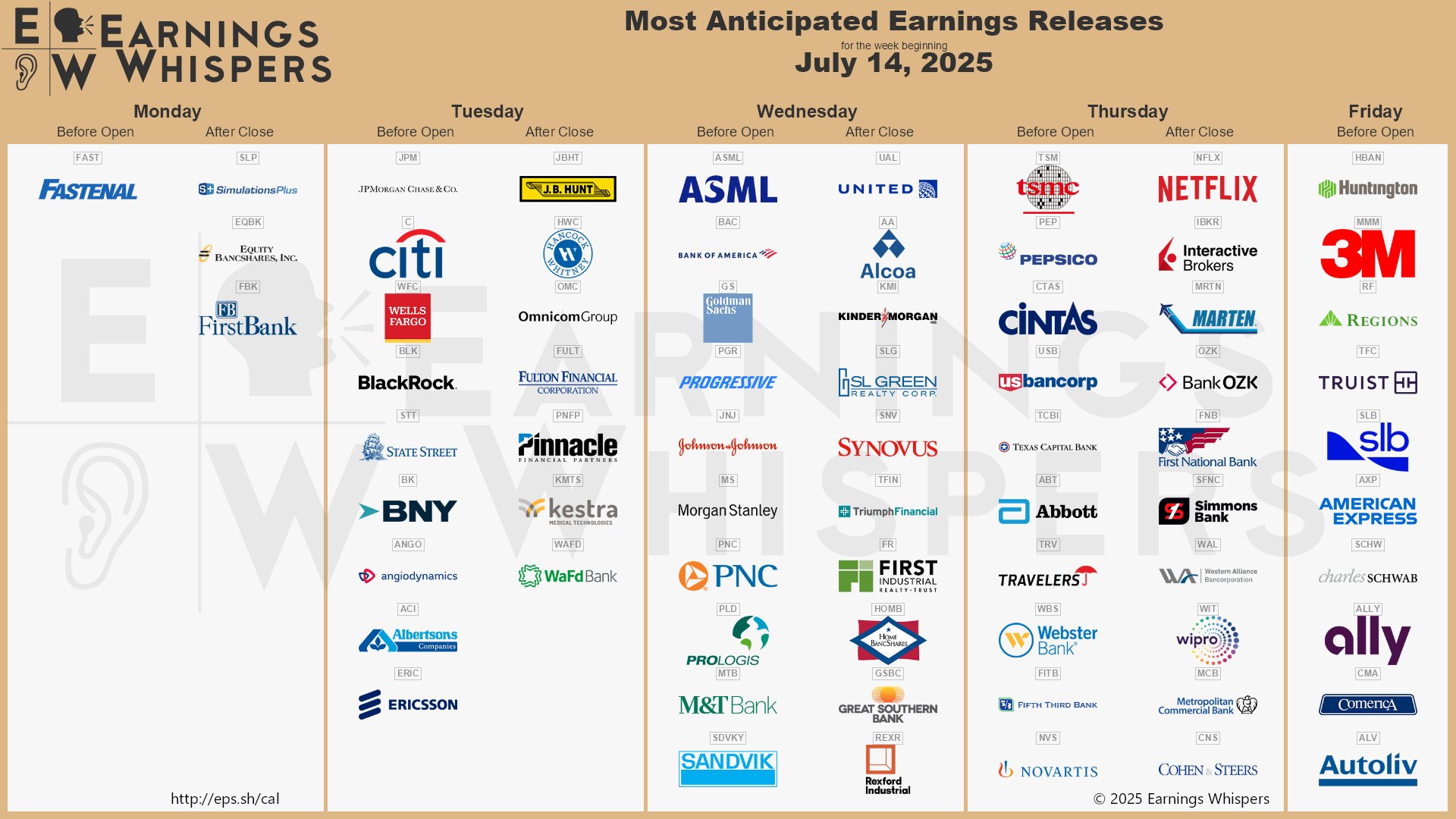

In addition to more tariff headlines (we’re still waiting on China), the latest inflation readings ( CPI & PPI ) are released this week, along with retail sales and housing figures. Earnings season also kicks off, with financial institutions reporting second quarter results and providing their insights into the rest of 2025.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.