Stock Market Outlook entering the Week of January 18th = Uptrend

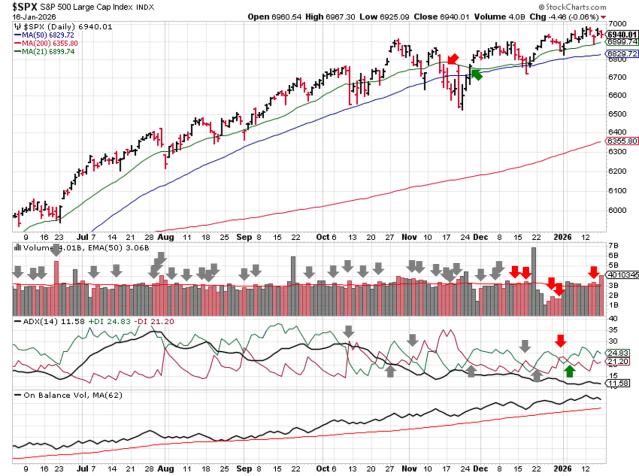

- Average Directional Index: Bullish

- Institutional Activity: Bullish

- On-Balance Volume: Bullish

ANALYSIS

The stock market outlook maintained an uptrend after navigating an eventful week geopolitical and policy headlines.

The S&P500 ( $SPX ) lost 0.4% last week. The index sits ~2% above the 50-day moving average and ~9% above the 200-day moving average.

All three technical indicators are bullish to start the week.

SPX Price & Volume Chart for Jan 18 2026

PERFORMANCE COMPARISONS

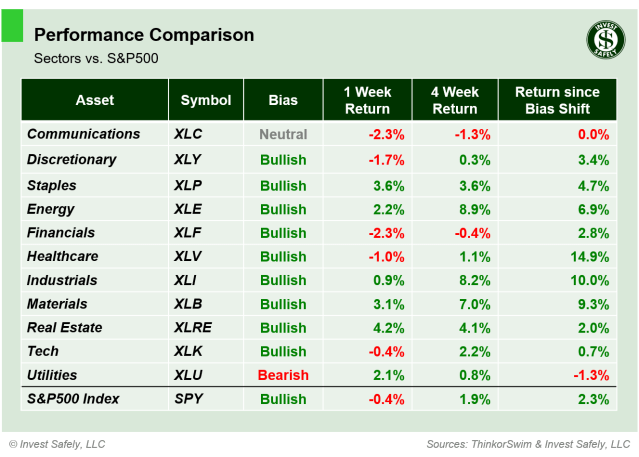

Real Estate ( $XLRE ) outperformed and switch to bullish bias, while Communications and Financials ( $XLC & $XLF ) tied for last place. Communications also fell to neutral bias.

S&P Sector Performance from Week 04 of 2026

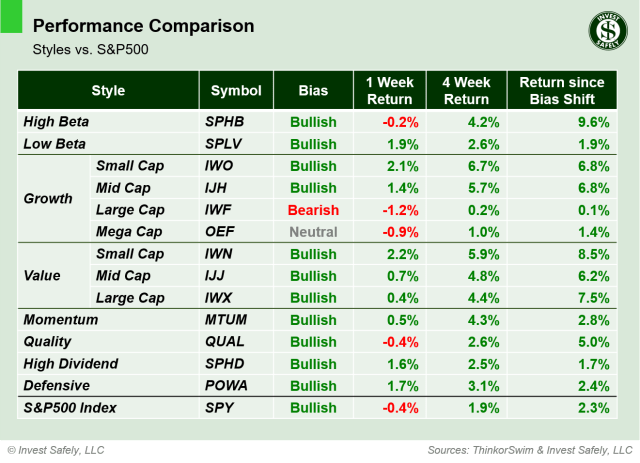

Small Cap Value ( $IWN ) led all performers for the second week in a row. Large cap growth ( $IWF ) underperformed and fell to bearish bias. Mega cap growth ( $OEF ) also eased back to neutral bias, while Low Beta ( $SPLV ) moved back to bullish from neutral.

Sector Style Performance from Week 04 of 2026

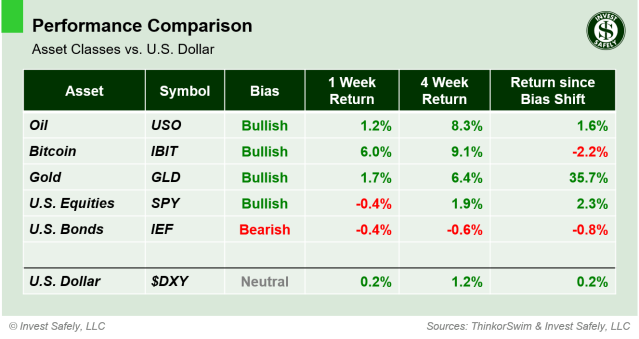

Bitcoin ( $IBIT ) outperformed last week and managed to regain bullish bias for the first time in several weeks. U.S. Bonds and Equities ( $IEF & $SPY ) lagged. Bonds also fell back to bearish bias.

Asset Class Performance from Week 04 2026

COMMENTARY

Last week was a long year! There were many news-worthy events, including:

- Federal Reserve Chair Jerome Powell was served grand jury subpoenas by the U.S.

- Justice Department regarding renovations at the Fed’s headquarters

- The Supreme Court did NOT release an opinion on the legality of U.S. tariffs

- U.S. military asset mobilization in response to ongoing protests in Iran.

The Trump administration added to the fray, announcing or proposing:

- A one-year 10% cap on credit card interest rates

- Fannie Mae and Freddie Mac purchasing $200 billion in mortgage-backed securities,

- A temporary delay in plans to garnish wages and offset tax returns for defaulted student loan borrowers

After the close on Friday, new tariffs were announced, this time on countries that oppose the U.S. annexation/acquisition of Greenland.

Macro-wise, December CPI (headline and core) remained steady versus November readings. Headline was down slightly year over year, while core inflation slowed significantly (down from 3.2% in Dec 2024).

| CPI (y/y) | Actual | Prior |

Expected |

| Headline | +2.7% | +2.7% | +2.7% |

| Core | +2.6% | +2.6% | +2.7% |

November PPI (headline and core) came in at 3%, slightly above October readings, but lower than December last year.

| PPI (y/y) | Actual | Prior |

Expected |

| Headline | +3.0% | +2.8% | +2.7% |

| Core | +3.0% | +2.9% | +2.7% |

Earnings season also kicked off, with a reminder of the ongoing, k-shaped economy: Banks with wealth management and investment banking business models reported significant growth, while those with a “mass-market” focus saw rising credit reserves (i.e. preparing for high loan defaults) and stagnant revenue growth. The proposed 10% cap on credit card interest rates didn’t help stock prices either.

And, just in case you were thinking “nothing would surprise me at this point”: a former policy expert in the UK said the Bank of England must plan for a financial crisis triggered by aliens.

This week, U.S. markets are closed Monday for the Martin Luther King Jr. Day. Final 2024 Q3 GDP and PCE for October and November will be released Thursday.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.