Stock Market Outlook entering the Week of December 14th = Uptrend

- Average Directional Index: Bullish

- Institutional Activity: Mixed

- On-Balance Volume: Bullish

ANALYSIS

The stock market outlook shows an uptrend, but stocks have struggled to make much progress over the past two weeks.

The S&P500 ( $SPX ) lost 0.6% last week. The index sits 1% above the 50-day moving average and ~10% above the 200-day moving average.

No change in the signals again this week; still waiting for institutional activity to confirm the latest rally attempt. It’s worth noting that we’re outside the ideal window for a follow-through day (4-7 days after the initial reversal). Wednesday looked like it had a chance, but didn’t manage to move more than 1%. During the wait, the market picked up 4 distribution days, which isn’t very promising.

SPX Price & Volume Chart for Dec 14 2025

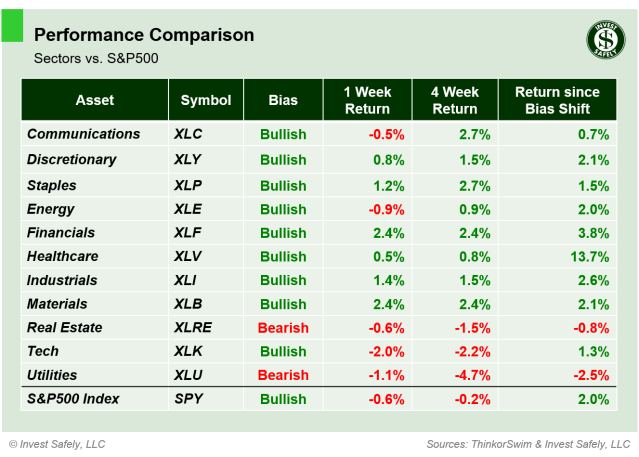

PERFORMANCE COMPARISONS

Financials and Materials ( $XLF & $XLB ) broke out last week. Technology ( $XLK ) led the to downside on AI-related worries. Staples and Materials ( $XLP & $XLB ) returned to bullish bias from Neutral.

S&P Sector Performance from Week 50 of 2025

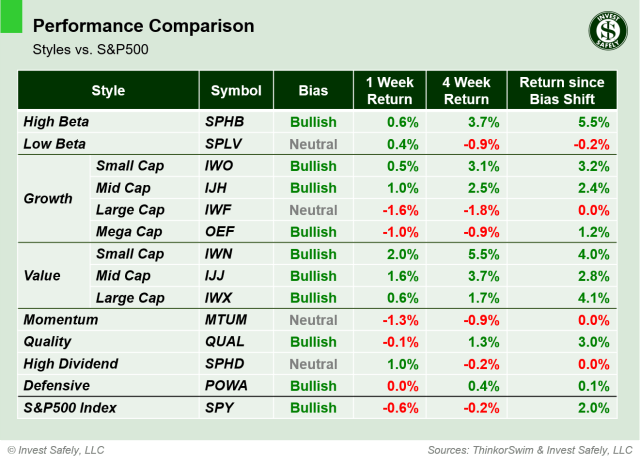

The Small Cap Value ( $IWN ) investing style was the largest gainer. Large Cap Growth ( $IWF ) was the largest loser, again thanks to AI worries. In a reversal of last week’s changes, Large Cap Growth and Momentum ( $IWF & $MTUM ) shifted back to neutral bias; Low Beta and High Dividend ( $SPLV & $SPHD ) styles moved up to neutral from bearish.

Sector Style Performance from Week 50 of 2025

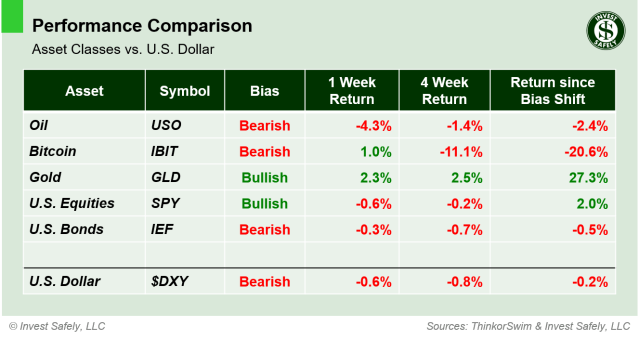

Oil ( $USO ) was the worst asset class last week, giving back most of the prior week’s improvement. Gold ( $GLD ) underperformed. Oil, U.S. Bonds and the U.S. dollar ( $USO, $IEF, $DXY ) all moved to bearish bias.

Asset Class Performance from Week 50 2025

COMMENTARY

The FOMC the overnight interest rate by 0.25%. No surprise there. They also announced the “purchase of shorter-term Treasury securities, as needed, to maintain an ample supply of reserves”. Some talking heads say this is quantitative easing, but that’s not quite right.

During quantitative tightening, which just ended, the Fed reduced its balance sheet by $2.4 trillion dollars. Now, they’ll let the balance sheet grow, as needed, to ensure our financial plumbing operates smoothly. This is basically the policy that was in place prior to the Great Recession. So it’s “easing” in the sense they’re shifting from tightening to maintaining. But have no illusions; if/when the economy/jobs weaken enough, the next round of QE will be unleashed in spectacular fashion.

Several macro tickers have moved back and forth between bias categories over the past 2 weeks, which can make for frustrated investors. Given the lack of confirmation from institutional activity, it pays to wait for a confirmation before scaling up any positions.

Looking ahead, a big week of macroeconomic data is on tap. On Tuesday, we get the first NFP report since the government shutdown, along with October retail sales. The market gets a chance to digest those numbers Wednesday, before the November CPI release Thursday. Exiting home sales for November hits the wire Friday.

It’s also a quadruple witching day; the final options expiration of the year, as well as the roll-over of equity futures contracts.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.