Stock Market Outlook entering the Week of November 23rd = Downtrend

- Average Directional Index: Bearish

- Institutional Activity: Bearish

- On-Balance Volume: Bullish

ANALYSIS

The stock market outlook shifted to a downtrend last Monday, putting equities into a correction after a gain of more than 20% from the April lows.

The S&P500 ( $SPX ) fell 1.9% last week. The index sits ~2% below the 50-day moving average and ~7% above the 200-day moving average.

The ADX is bearish. Institutional selling ramped up, adding 3 distribution days to the count. But it was Monday’s high volume move through the 50-day moving average that shifted the indicator to bearish and the outlook to a downtrend.

SPX Price & Volume Chart for Nov 23 2025

PERFORMANCE COMPARISONS

Healthcare ( $XLV ) led sectors higher for the third straight week; the only sector showing any real resilience. Energy ( $XLE ) is the other bullish sector, but it’s still finding its footing. Technology ( $XLK ) underperformed significantly and dropped to bearish bias. Utilities ( $XLU ) eased back to neutral.

S&P Sector Performance from Week 47 of 2025

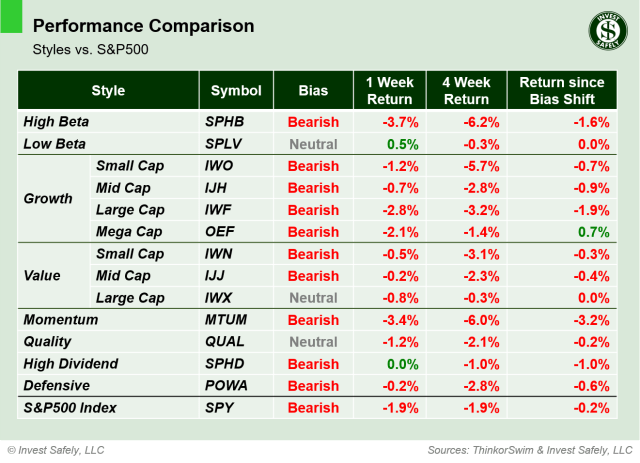

Low Beta ( $SPLV ) outperformed other sector styles, but still lost steam during the week and moved to neutral bias. Momentum ( $MTUM ) led to the downside. High Beta, Large and Mega Cap Growth ( $SPHB, $IWF, $OEF ) moved to bearish bias; Large Cap Value and Quality ( $IWX, $QUAL ) moved to neutral.

Sector Style Performance from Week 47 of 2025

Bonds ( $IEF ) outperformed last week, but all assets have been weaker versus the dollar. The crypto space continues to experience deleveraging, so no surprise that Bitcoin ( $IBIT ) was the laggard again.

Asset Class Performance from Week 47 2025

COMMENTARY

Institutions were definitely reducing their exposures last week, especially on Thursday. Market participants dumped risk-on plays, such as the Technology sector, High Beta/Momentum sector styles, and cryptocurrency assets. Excluding crypto, those categories are still within 10% of their all time highs, so they’re not priced at a discount just yet ( $SPHB was up ~80% from the April low ).

Last week’s release of FOMC minutes showed that members are divided on how to proceed on interest rates: lower them to help the job market or keep them steady to fight inflation. Equity market participants were pricing in a December rate cut. A less than certain reduced that probability, which may have influenced capital flows last week.

Although they’re fewer and farther between these days, corrections are normal and actually a welcome aspect of investing. When they occur, investors get a chance to find assets that are “truly” oversold, or at the very least no longer overbought.

Corrections aren’t typically “one and done”, meaning there’s usually a retest and then another move lower. We saw this play out earlier in the year, when stocks sold off in February, consolidated in March, then bottomed in April. Perhaps we correct in November, get that Santa Claus rally in December, and bottom in January closer to the 200-day moving average.

Regardless of the narrative, risk-on assets are bearish across a wide range of categories right now. While there are pockets of strength for short-term plays ( e.g. Healthcare ), you’ll want to broader participation before making moves. Or at least see the Mag 7 turn around, since they’re so heavily weighted within indexes.

Over the coming sessions, dust off those watchlists, pick companies with high quality fundamentals with high quality chart patterns, and then look for signs that institutions are back on the buy side: accumulation days ( large daily moves higher on increasing volume ) and price regaining/remaining above key moving averages ( 21 day and 50 day ).

Next week starts the holiday trading season, with Thursday market closures for thanksgiving in the US. PPI and retail sales on Tuesday, Durable Goods on Wednesday. The Bureau of Economic Analysis (BEA) initially scheduled PCE for Wednesday, but the release has been delayed.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.