Stock Market Outlook entering the Week of November 2nd = Uptrend

- Average Directional Index: Uptrend

- Institutional Activity: Uptrend

- On-Balance Volume: Uptrend

ANALYSIS

The stock market outlook shows an uptrend for U.S. equities.

The S&P500 ( $SPX ) rose 0.7% last week. The index sits ~3% above the 50-day moving average and ~12% above the 200-day moving average.

All three indicators show bullish price action. The index saw elevated selling on Thursday and Friday, but neither session met the criteria for a distribution day.

SPX Price & Volume Chart for Nov 02 2025

PERFORMANCE COMPARISONS

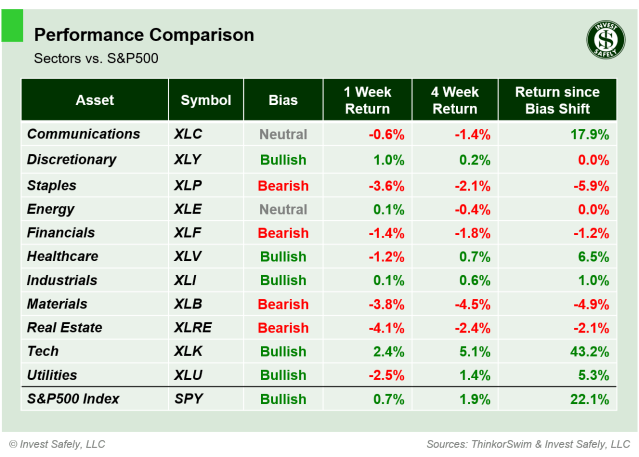

The Tech sector ( $XLK ) led stocks higher again, while Real Estate ( $XLRE ) underperformed, along with Materials and Consumer Staples ( $XLB & $XLP ).

Financials and Real Estate ( $XLF, $XLRE ) fell to bearish bias; Communications ( $XLC ) eased to neutral after rising almost 18% since it shifted to bullish back in May.

S&P Sector Performance from Week 44 of 2025

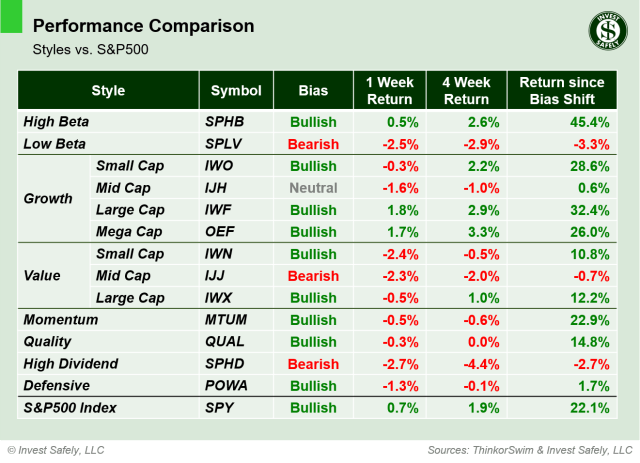

Large and Mega Cap Growth ( $IWF & $OEF ) outperformed, while High Dividend, Low Beta, Small and Midcap Value ( $SPHD, $SPLV, $IWN, $IJJ ) underperformed significantly.

Mid Cap Growth and Value ( $IJH, $IJJ ) were on the move again this week; Mid Cap Growth slowed back to Neutral and Mid Cap Value fell to Bearish bias.

Sector Style Performance from Week 44 of 2025

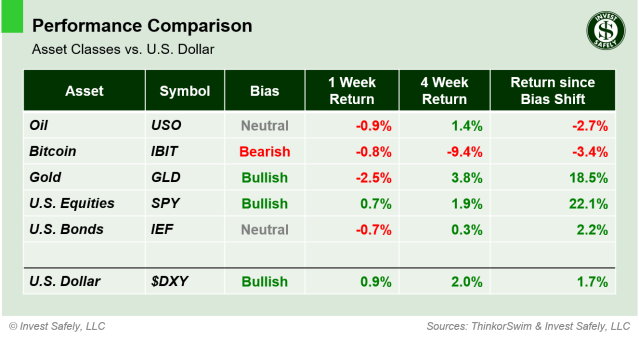

The U.S. Dollar ( $DXY ) was the best asset last week, so that was headwind for the other classes ( Gold struggled the most ). Bonds went back to Neutral bias.

Asset Class Performance from Week 44 2025

COMMENTARY

The FOMC decided to lower interest rates 0.25% last week. Given the lack of government data, there was a very small chance of no change, but the number of recent layoff announcements probably spooked them enough to do something.

5 of the Magnificent 7 have reported earnings last week, and Amazon ( $AMZN ) stole the show, in terms of price performance, gaping up ~12%. Alphabet ( $GOOGL ) also performed well, while Apple’s stock price didn’t respond much. Microsoft ( $MSFT ) didn’t far as well, reversing the positive, post-earnings move by the end of the week, and Meta ( $META ) was punished after the company announced plans for $100 billion in AI investments for 2026.

The U.S. and China reached a trade deal over the weekend, which will remove many of the recent trade barriers the two countries enacted. The deal should reduce supply chain issues for a number of industries, including semiconductors, rare earth materials, agriculture. Expect to see some volatility in Sunday futures … much like prior trade-deal headlines that occurred while markets were closed.

Looking ahead, ISM Manufacturing and Services PMI data is released Monday and Wednesday, respectively. Since it’s unlikely we’ll see any government data releases, attention shifts to private sector reporting, namely ADP Employment Change on Wednesday, and Challenger Job cuts on Thursday.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.