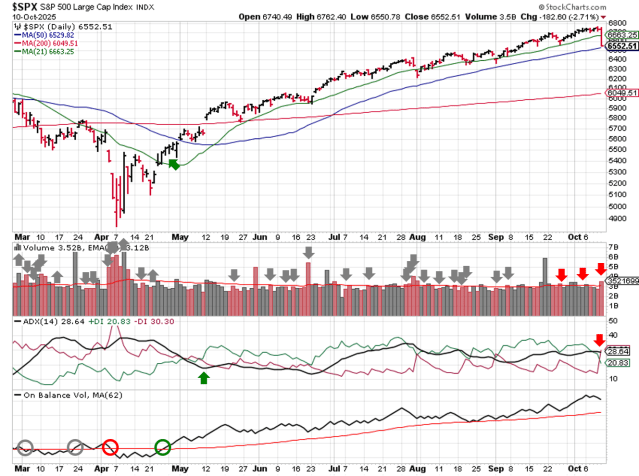

Stock Market Outlook entering the Week of October 12th = Uptrend

- Average Directional Index: Downtrend

- Institutional Activity: Uptrend

- On-Balance Volume: Uptrend

ANALYSIS

The stock market outlook continues to show an uptrend for U.S. equities, despite Friday’s meltdown.

The S&P500 ( $SPX ) fell 2.4% last week, with all the damage occurring during Friday’s session. The index sits less than 1% above the 50-day moving average and ~8% above the 200-day moving average.

The ADX indicator flipped to bearish; not a surprise given Friday’s move. In addition to Friday’s distribution day, there was a stalling day on October 3rd missed in the last update, bringing the total count to 3.

SPX Price & Volume Chart for Oct 12 2025

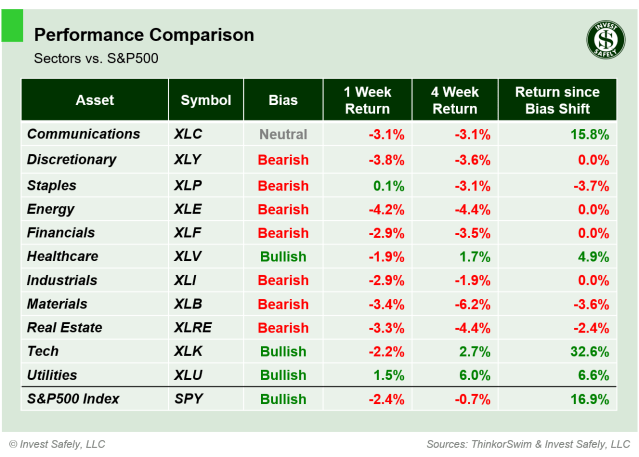

PERFORMANCE COMPARISONS

Utilities ( $XLU ) escaped the week with a gain, Consumer Staples basically broke even. Otherwise a lot of losses, led lower by Energy ( $XLE ). Consumer Discretionary, Energy, Financials, Industrials, Materials, and Real Estate ( $XLY, $XLE, $XLF, $XLI, $XLB, $XLRE ) all dropped to Bearish bias, and Communications ( $XLC ) fell to Neutral.

S&P Sector Performance from Week 41 of 2025

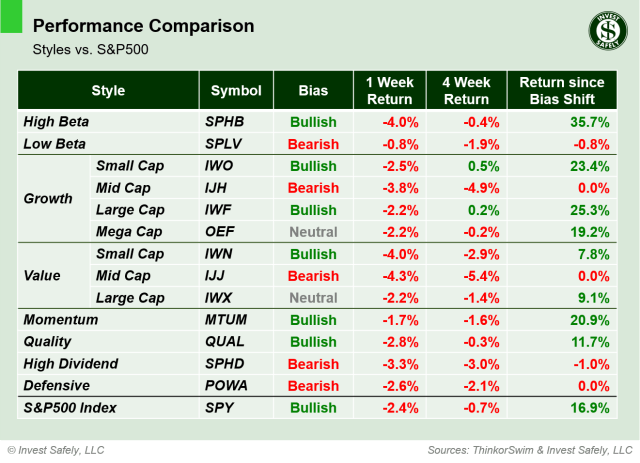

All sector styles registered a loss lasts week; Low Beta ( $SPLV ) was the least “bad” and Mid Cap Value ( $IJJ ) was the worst. Low Beta, Mid Cap Growth and Value, High Dividend and Defensive ( $SPLV, $OJH, $IJJ, $SPHD, $POWA ) all moved to Bearish Bias; Mega Cap Growth and Large Cap Value ( $OEF, $IWX ) moved to neutral.

Sector Style Performance from Week 41 of 2025

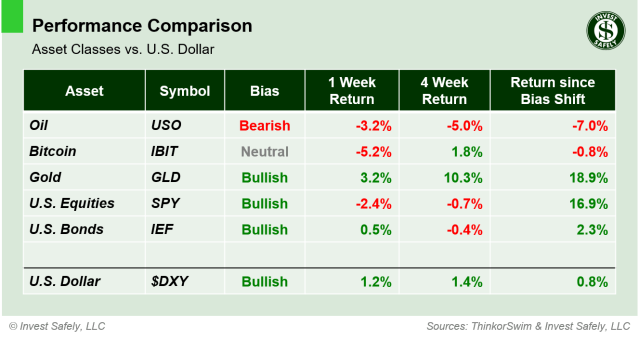

Bitcoin ( $IBIT ) led Oil and U.S. equities lower, while Gold outperformed to the upside. Bitcoin also moved to Neutral bias, while the U.S. Dollar moved to bullish.

Asset Class Performance from Week 41 2025

COMMENTARY

Friday’s trading session was a reminder that substantial geopolitical risks remain in play, even if the market has largely ignored them since April. The massive sell-off was sparked by a social media post from President Trump at 10:57 a.m., lamenting China’s recent stance on sourcing rare earth metals and potential response options.

The volatility was especially bad for crypto markets, resulting in forced liquidations and other “emergency” measures. The level of wealth destruction is a sobering reminder that crypto remains a highly leveraged, highly speculative, low liquidity asset class, despite making inroads into institutional portfolios and fund offerings.

The silver lining was a lack of by institutional selling, seen in the indexes, leading up to Friday’s meltdown. Now we need to see how institutions respond; was this a one time event that’s recovered quickly, or the start of repricing for a higher risk environment. Watch volatility ( $VIX ) for the next few days; it spiked into the 20’s on Friday and needs to retreat quickly to avoid altering capital flows.

U.S. equity sectors and styles flirted with bias changes over the past few weeks, so the fact that Friday’s sell-off pushed many into bearish territory isn’t too surprising. Recent outperformance by Utilities and Healthcare is a bit more interesting, as those sectors typically lead when growth and inflation are slowing.

Keep an eye on the U.S. dollar as well. It’s moved to bullish bias now, and may have completed its own bottoming process in mid-September, which would also contribute to weaker returned for equities, from a historical perspective.

Monday’s session is also a bit of an unknown, as equity markets are open despite a bank holiday here in the U.S. Any residual liquidity issues created Friday, or new ones created Monday, may not be rectified until Tuesday. It’s possible volatility could drag on into the middle of next week.

Federal Reserve officials were already planning to work overtime next week, slated for a total of 18 speaking engagements! September PPI was on the schedule, but we won’t see those numbers unless the government shutdown ends.

And in the background of all this market “drama” is the start of earnings season, with major investment banks kicking things off on Tuesday!

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.