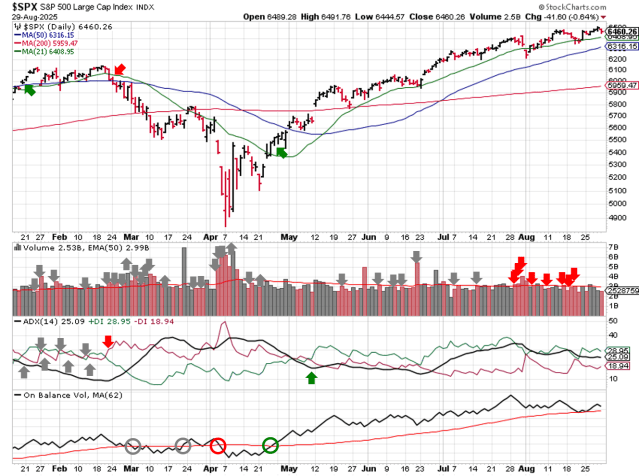

Stock Market Outlook entering the Week of August 31st = Uptrend

- Average Directional Index: Uptrend

- Institutional Activity: Neutral

- On-Balance Volume: Uptrend

ANALYSIS

The stock market outlook continues to show an uptrend for U.S. equities.

The S&P500 ( $SPX ) fell 0.1%. The index sits ~2% above the 50-day moving average and ~8% above the 200-day moving average.

SPX Price & Volume Chart for Aug 31 2025

On-balance is back in bullish territory, but also shows a bearish divergence since the end of July. The ADX has also faded over that period of time, suggesting the current rally is losing some steam. The market got a reprieve from institutional selling last week, and distribution days will start falling off the count through the week.

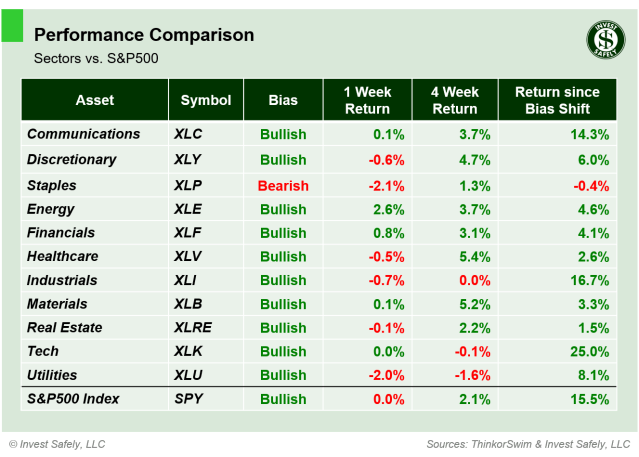

PERFORMANCE COMPARISONS

Energy ( $XLE ) led sectors higher again last week; Utilities and Consumer Staples ( $XLU & $XLP ) were the worst performers. Staples also dropped to bearish bias.

S&P Sector Performance from Week 35 of 2025

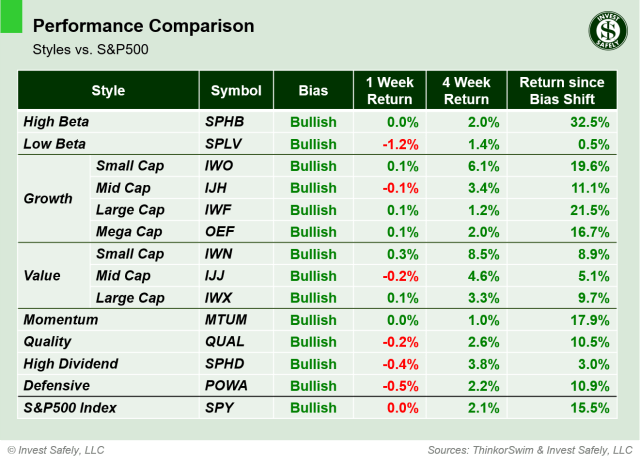

Small cap value ( $IWN ) outperformed for a third week, but the overall gains were small. Low Beta ( $SPLV ) was the laggard. No changes in bias; all styles are bullish.

Sector Style Performance from Week 35 of 2025

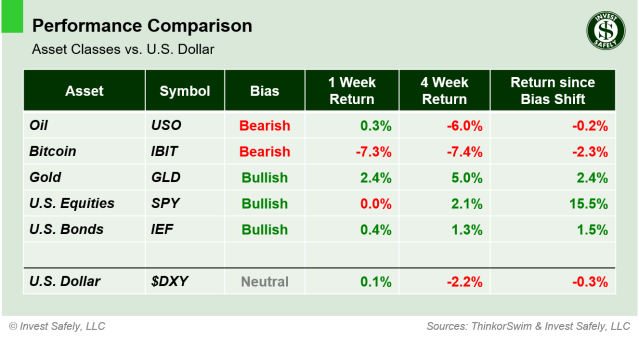

Gold ( $GLD ) led assets to the upside, while Bitcoin ( $IBIT ) was the worst performer for the second week in a row. Adding insult to injury, Bitcoin ( $IBIT ) starts September with a bearish bias. The US Dollar ( $DXY ) is back to neutral.

Asset Class Performance from Week 35 2025

COMMENTARY

Nvidia ($NVDA) reported better than expected results last week, but the stock price took a small hit because analysts were expecting higher data center revenues ($41.1b vs $41.3b). Guidance for next quarter was also lower than expected, largely because they’re not including sales to China. Since the stock accounts for 8% of the S&P500, it’s price has an oversized impact on the index.

The second estimate of Q2 GDP came in higher than the first, from 3% to 3.3%, mainly due to upward revisions to investments and consumer spending data.

Headline PCE data for July was inline with estimates, while Core was slightly higher. For the first time in many months, there were no revisions to prior data!

| PCE (y/y) | Actual | Prior |

Expected |

| Headline | +2.6% | +2.6% | +2.6% |

| Core | +2.9% | +2.8% | +2.9% |

This week, U.S. markets are closed on Monday for Labor Day. Later in the week, we’ll get the latest PMI data, as well as JOLTs and NFP.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.