Stock Market Outlook entering the Week of August 24th = Uptrend

- Average Directional Index: Uptrend

- Institutional Activity: Neutral

- On-Balance Volume: Neutral

ANALYSIS

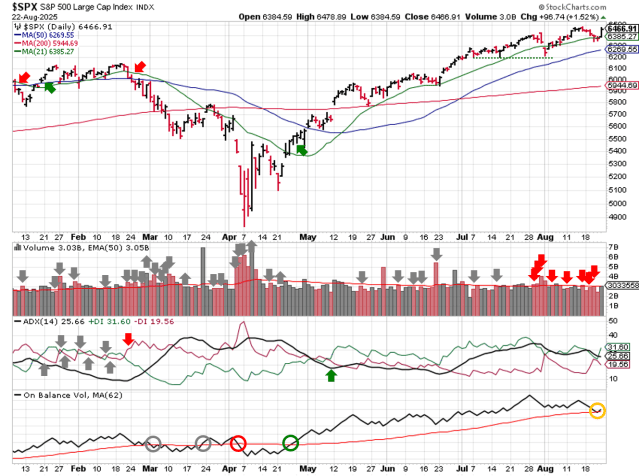

The stock market outlook continues to show an uptrend for U.S. equities, though institutional selling increased again.

The S&P500 ( $SPX ) rose 0.3%. The index sits ~3% above the 50-day moving average and ~9% above the 200-day moving average.

The market encountered more distribution days last week, bringing the total to 7. Price remains above the 50-day, and bounced on Friday, so the signal remains neutral for now. On-balance volume also eased the past few weeks and is now resting on its moving average.

SPX Price & Volume Chart for Aug 24 2025

PERFORMANCE COMPARISONS

Energy ( $XLE ) led sectors higher, while Technology was underperformed ( $XLK ). Energy and Real Estate ( $XLE & $XLRE ) regained bullish bias.

S&P Sector Performance from Week 34 of 2025

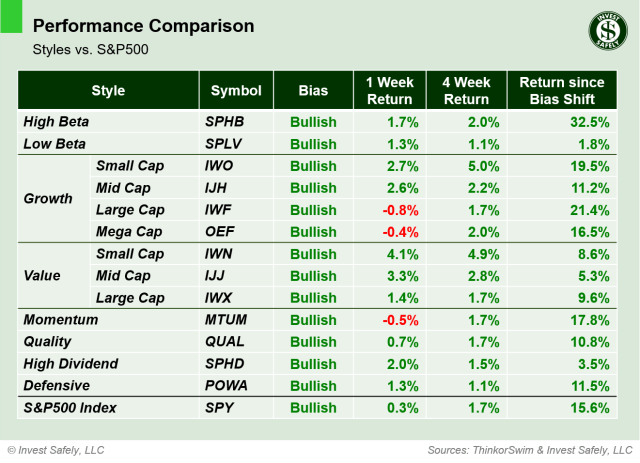

Small cap value ( $IWN ) outperformed for a second straight week, while Large Cap Growth was the laggard ( $OEF ). No changes in bias; all styles are bullish.

Sector Style Performance from Week 34 of 2025

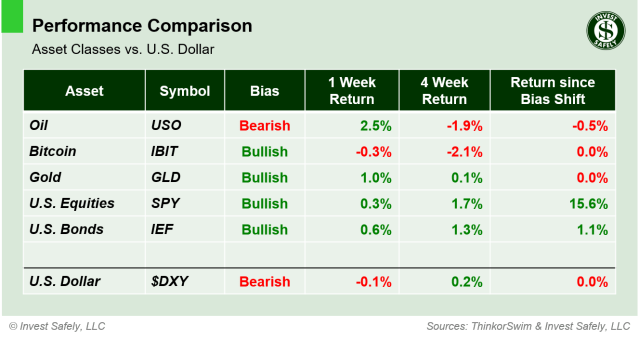

Oil ( $USO ) led assets higher and Bitcoin ( $IBIT ) underperformed. Gold ( $GLD ) is back to bullish bias after some recent weakness.

Asset Class Performance from Week 34 2025

COMMENTARY

After 4 straight days of selling in U.S. equity indexes, Federal Reserve Chairman Powell came to the rescue on Friday. During his remarks from Jackson Hole, signaled a potential shift in the interest rate discussion. In particular, most people focused on the following statement:

“…with policy in restrictive territory, the baseline outlook and the shifting balance of risks may warrant adjusting our policy

stance.”

Those words were interpreted as an interest rate cut is coming in September. Some are going further, using what Powell didn’t say as an indicator the Fed has stopped pursuing the 2% inflation target as a near-term goal, and will focus policy on labor and economic growth. Time will tell. Prior to the next FOMC meeting, there’s another round of inflation data ( PCE, CPI, and PPI ), as well as the August non-farm payrolls data.

If/when rates are lowered, expect to see a reduction in your short-term interest payments ( savings accounts, interest-bearing checking accounts, money markets, short-term bonds, etc. ).

A quick note about the signals presented above, specifically the institutional selling. Given the relative weighting of technology stocks ( e.g. Mag 7 ), the index can suffer from market-cap distortions, where downside moves are caused by just a few stocks. This can make the overall market drop, while a majority of tickers are breakeven or higher.

The tables above show that Technology/Communications sectors and Mega/Large Cap growth styles underperformed last week, and likely drove a lot of the action at an index level. Recent underperformers and/or bias tests have bounced back as well, meaning the the high volume likely reflects end of summer asset reallocation, rather than outright selling of equities ( which we’ve discussed over the past few weeks as a wise move for your holdings as well ).

This week, we get an updated Q2 GDP figure Thursday and the aforementioned PCE reading for July on Friday. All of which could be overshadowed by Nvidia earnings Wednesday after market close.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.