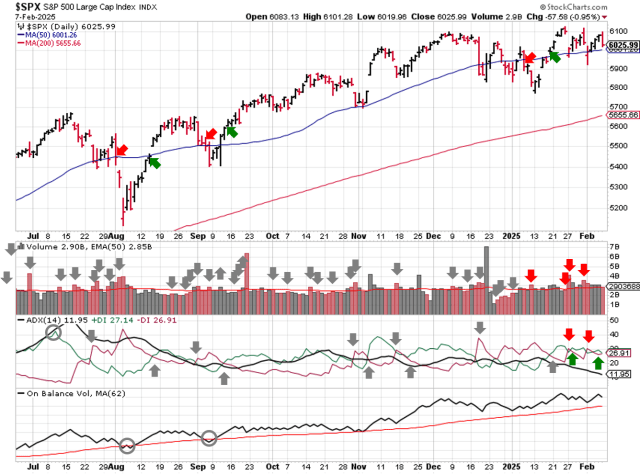

Stock Market Outlook entering the Week of February 9th = Uptrend

- ADX Directional Indicators: Mixed

- Institutional Activity (Price & Volume): Uptrend

- On Balance Volume Indicator: Uptrend

ANALYSIS

The stock market outlook remains in an uptrend, although recent market moves have been “choppy” at best.

The S&P500 ( $SPX ) fell 0.2% last week. The index is ~0.4% above the 50-day moving average and ~7% above the 200-day moving average.

SPX Price & Volume Chart for Feb 09 2025

The ADX worked some overtime last week, flipping from bullish to bearish, then back to bullish, and heads into the week on the verge of shifting to bearish again. Several distribution days come off the count during the week, so institutional activity moves back to an uptrend (from mixed) with the 50-day moving average close at hand. No change in On-Balance Volume.

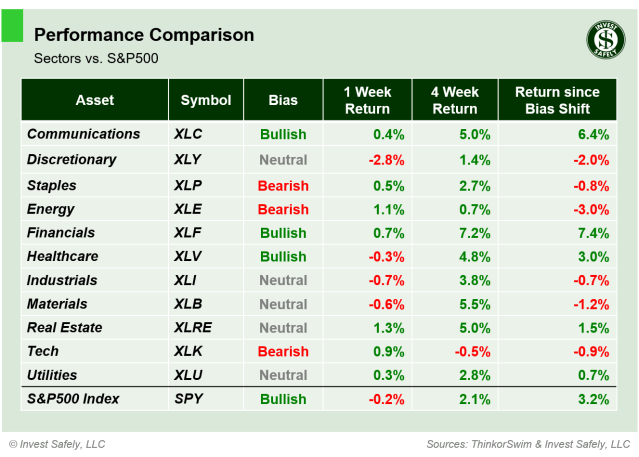

S&P Sector Performance for Week 06 of 2025

Real Estate ( $XLRE ) led sector performance last week, and moved from bearish to neutral bias. Consumer Discretionary ( $XLY ) was the worst sector, and also fell to neutral trend. Since the prior shift, which was ~175 days ago, $XLY is up 26%. The trend is your friend indeed. Industrials ( $XLI ) moved back to a neutral bias.

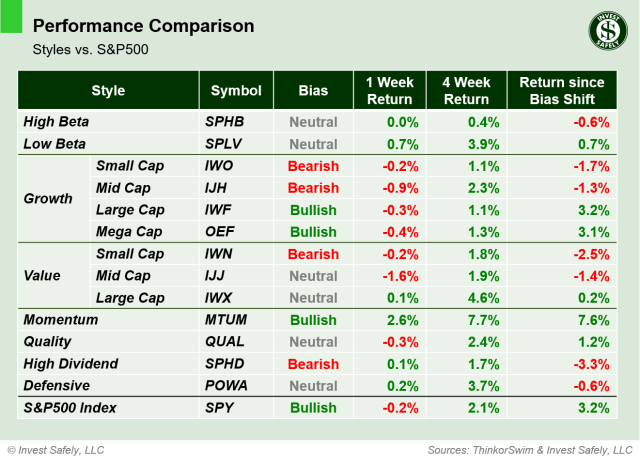

Sector Style Performance for Week 06 of 2025

Despite the back and forth nature seen in other areas, the Momentum ( $MTUM ) style outperformed last week. Mid-Cap Growth ( $IJH ) lagged and moved from neutral to bearish bias. Mid-Cap Value ( $IJJ ) and Quality ( $QUAL ) styles fell back to neutral.

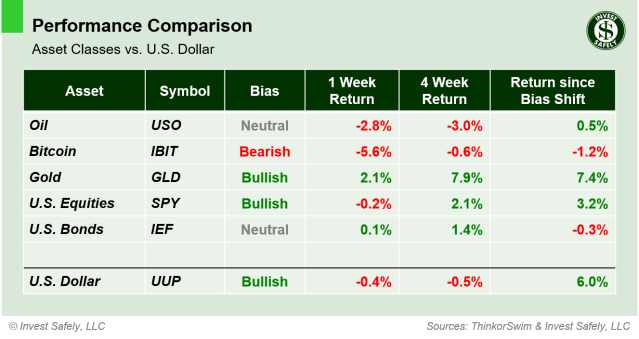

Asset Class Performance for Week 06 2025

Bitcoin ( $IBIT ) was the worst performer again last week, sinking more than 5% and dropping to a bearish bias. Gold ( $GLD ) was the best performer, and has been over the past 4 weeks as well. Oil ( $USO ) shifted from Bullish to Neutral

COMMENTARY

ISM Manufacturing data rose in January, getting back into expansion territory (>50) for the first time since September 2022! ISM Services weakened slightly, but also remains expansionary.

On the labor front, JOLTs data showed fewer job openings in December, and January NFP data was down significantly versus December, but higher than last year at this time.

Rumors of retaliatory tariffs spooked the market late last week, and sellers took control just as they had during the prior 2 Friday sessions (24th and 31st of January). Protect your capital, keep your losses small, and deploy capital when probabilities are in your favor (oversold in bullish trends, like the Healthcare sector was on Friday).

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.