Stock Market Outlook entering the Week of December 29th= Uptrend

- ADX Directional Indicators: Downtrend

- Institutional Activity (Price & Volume): Mixed

- On Balance Volume Indicator: Uptrend

ANALYSIS

The stock market outlook remains in an uptrend heading into 2025.

The S&P500 ( $SPX ) gained 0.7%. The index is 0.5% above the 50-day moving average and ~8% above the 200-day moving average.

SPX Price & Volume Chart for Dec 29 2024

No change in the signal set, so last week’s analysis remains valid and the overall outlook is unchanged:

Short-term (ADX) is bearish, responding to the lower lows and lower high. Mid-term (Institutional Activity) is mixed, with the index trading down to the 50-day moving average, but only a small number of distribution days. Long-term (On Balance Volume) is still bullish, though does show the impact of selling pressure since the start of the month.

S&P Sector Performance for Week 52 of 2024

Technology ( $XLK ), led the way again, this time rising 2.2%. Consumer Staples ( $XLP ) led to the downside, dropping 0.5%. Financials ( $XLF ) rose from neutral back to bullish.

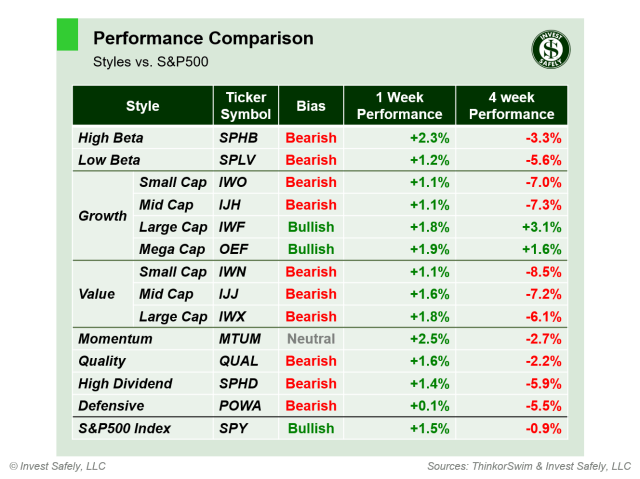

Sector Style Performance for Week 52 of 2024

After a rough stretch, sector styles rallied last week. Momentum outperformed; Defensive underperfomed. Momentum shifted from Bearish to Neutral trend.

Asset Class Performance for Week 52 2024

Oil ( $USO ) led the way higher last week, while Bitcoin was the worst performer. The U.S. dollar was flat for the week; a $1.32 dividend for the $UUP etf accounted for the 4.5% drop in price.

In what seems like a weekly occurrence, Oil flipped back to bullish trend, from neutral. That said, the chart looks appears to show the waning stages of a bottoming process (a series of higher lows since late October).

COMMENTARY

Not really a December to remember for U.S equities. Hopefully, a quiet week was just what equities needed.

One macro datapoint to share: November durable goods orders fell 1.1% M/M, versus a 0.8% rise in October.

Another shortened week of trading, with U.S. market closed on Wednesday for New Year’s Day.

Whether you crushed it or got crushed, may your 2025 be better than your 2024. Wishing you joy and good cheer as we close out the holiday season.

Best to Your Week, and Happy New Year!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.