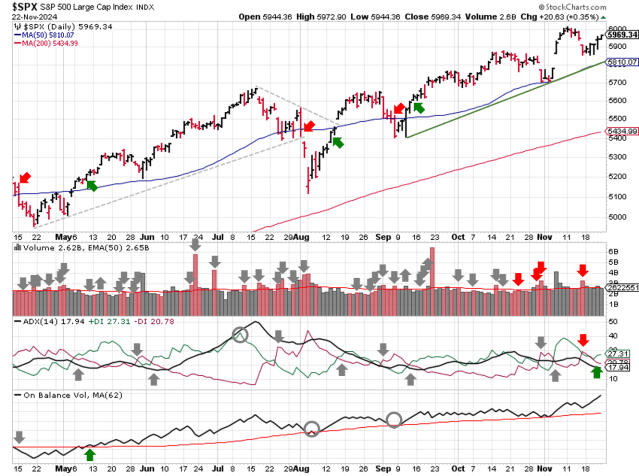

Stock Market Outlook entering the Week of November 24th = Uptrend

- ADX Directional Indicators: Uptrend

- On Balance Volume Indicator: Uptrend

- Institutional Activity (Price & Volume): Uptrend

ANALYSIS

The stock market outlook remains in an uptrend, erasing most of the prior week’s correction.

The S&P500 ( $SPX ) rose 1.7%. The index sits ~3% above the 50-day moving average and ~10% above the 200-day moving average.

SPX Price & Volume Chart for Nov 24 2024

The ADX ( Average Directional Index ) shifted to back to an uptrend on Thursday. Institutional Activity and OBV ( On-Balance Volume ) remain in bullish territory.

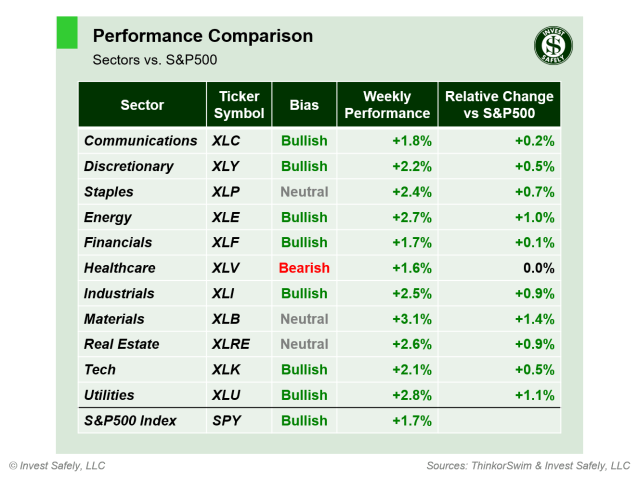

S&P Sector Performance for Week 47 of 2024

All sectors rallied, with Materials ( $XLB ) leading the way. Healthcare ( $XLV ) was the “worst” performer with a 1.6% gain; inline with the general market. Longer-term, some bullishness crept back into Consumer Staples ($XLP ), Materials ($XLB ), Real Estate ($XLRE ) moved back to a neutral bias and Utilities ($XLU ) went bullish.

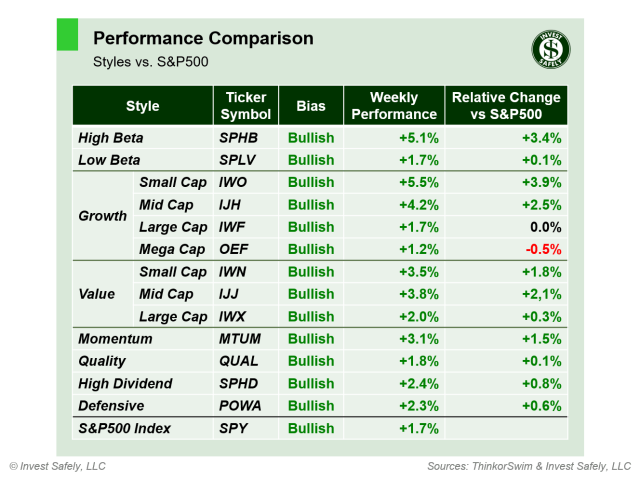

Sector Style Performance for Week 47 of 2024

After leading to the downside the week prior, Small Cap Growth ( $IWO ) was the best performer this week. Mega Cap Growth ( $OEF ) couldn’t match the general market gains, but still closed up for the week. Longer-term, the High-Dividend sector style ( $SPHD ) found support at key technical levels and shifted back to a bullish bias.

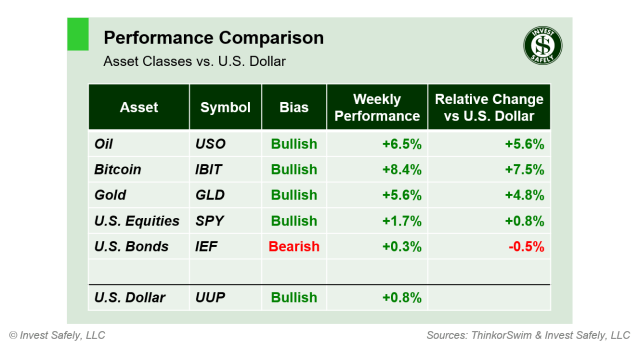

Asset Class Performance for Week 47 2024

Another week, another new high for Bitcoin ( $IBIT ). Gold ( $GLD ) and Oil ( $USO ) also joined in, punching back into bullish bias territory. Bonds also rallied slightly, but remain in bearish bias territory.

COMMENTARY

Nvidia’s earnings report showed sales almost doubling y/y, while earnings did double (+111%)! 4th quarter guidance wasn’t as “high”, estimating sales and earnings growth at slightly more than 70% in 2025.

A holiday shortened trading week on tap, with U.S. markets closed on Thursday ( Thanksgiving Holiday ) and Friday’s session ends at 1:00pm EST.

Trading volumes are likely lower, but that doesn’t necessarily mean calm price action; we’ll get FOMC minutes on Tuesday afternoon, as well as PCE and the 2nd Q3 GDP estimate during Wednesday’s pre-market.

Be on the lookout for opportunities to rotate out of overbought names and into those that are oversold, within the sectors, styles, and assets with a bullish bias.

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.