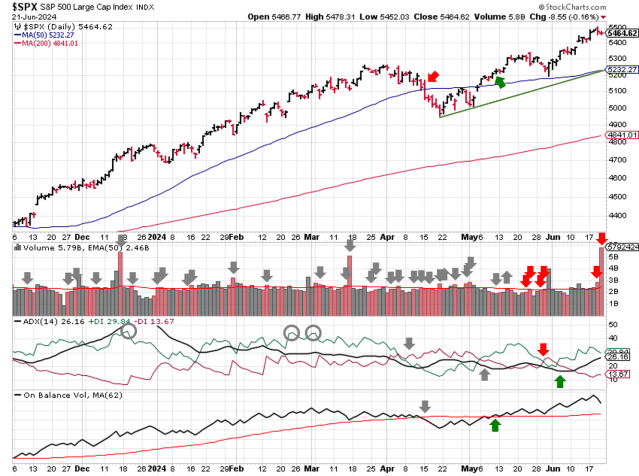

Stock Market Outlook entering the Week of June 23rd = Uptrend

- ADX Directional Indicators: Uptrend

- On Balance Volume Indicator: Uptrend

- Institutional Activity (Price & Volume): Uptrend

ANALYSIS

The stock market outlook shows an uptrend in place for U.S. equities.

The S&P500 ($SPX) rose 0.6% last week. The index ended the week ~4% above the 50-day moving average and ~13% above the 200-day moving average.

SPX Price & Volume Chart for the Week of June 23 2024

All three indicators (ADX, On Balance Volume and Institutional activity) remain bullish.

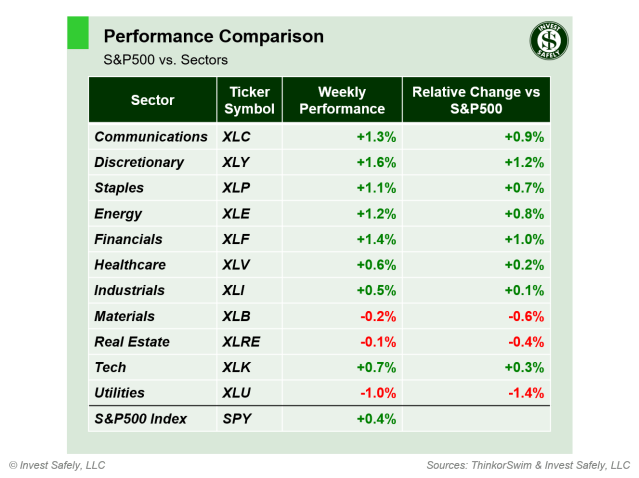

Consumer Discretionary ($XLY), led by Amazon, Tesla, and Home Depot, was the best sector last week. Utilities ($XLU) led to the downside.

S&P Sector Performance for Week 25 of 2024

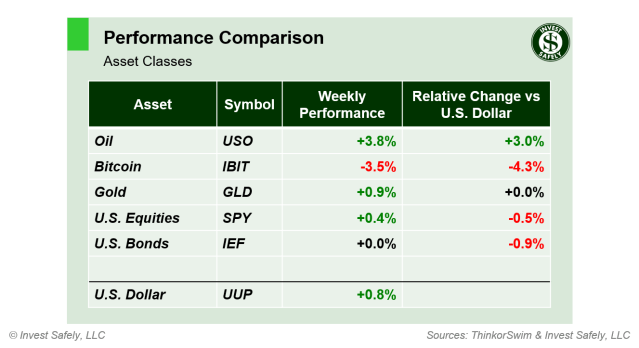

The trend in asset prices carried over for a second week in a row, with oil leading to the upside (+3.8%) and Bitcoin leading downward (-3.5%). Those returns put their two week performance at +8% and -9.2%, respectively.

Asset Class Performance for Week 25 of 2024

COMMENTARY

May retail sales were up 2.3% versus last year; slightly lower than the 2.7% y/y increase seen in April. Otherwise, a fairly quiet week on the macroeconomic front.

Most of the commotion occurred withing futures and options; Friday’s quarterly options expiration was the largest ever.

This week, we get the final Q1 GDP figure (Thursday) and May PCE data (Friday).

Best to Your Week!

P.S. If you find this research helpful, please tell a friend.

If you don’t, tell an enemy.